It is 2026. Your biggest competitor just updated their API documentation to include "Enterprise SSO." They haven't announced it. Marketing hasn't tweeted about it. But the code is there. Three months from now, they will launch an aggressive move upmarket to steal your biggest accounts. If you find out today, you can prepare a "Value vs. Complexity" campaign to inoculate your base. If you find out in three months—when you read their press release along with everyone else—you are already dead.

TL;DR: Most companies treat competitive intelligence as a history project. They write "Quarterly Reports" about things that happened 90 days ago. But intelligence has a shelf life. Data decays instantly. This guide introduces the Agile Intelligence methodology, powered by the OODA Loop (Observe, Orient, Decide, Act). We'll cover how to map your digital footprint, automate collection with AI, and turn noise into revenue-generating strategy.

The Core Problem: Intelligence Has a Shelf Life

In the age of AI, information is not power. Speed of information is power.

If you learn that a competitor changed their pricing today, that information is platinum. You can counter-pitch active deals immediately. If you learn it next month, that information is lead. The deals are already lost.

Most SaaS companies are stuck in the "Quarterly Report" era. They compile massive PDF decks that nobody reads, detailing everything a competitor did last season. This is archaeology, not intelligence.

The Paradigm Shift: Static vs. Agile Intelligence

After monitoring 1,000+ SaaS companies, Lensmor found that market leaders don't just collect more data—they cycle through data faster.

To survive in 2026, you must adopt a military-grade framework: The OODA Loop.

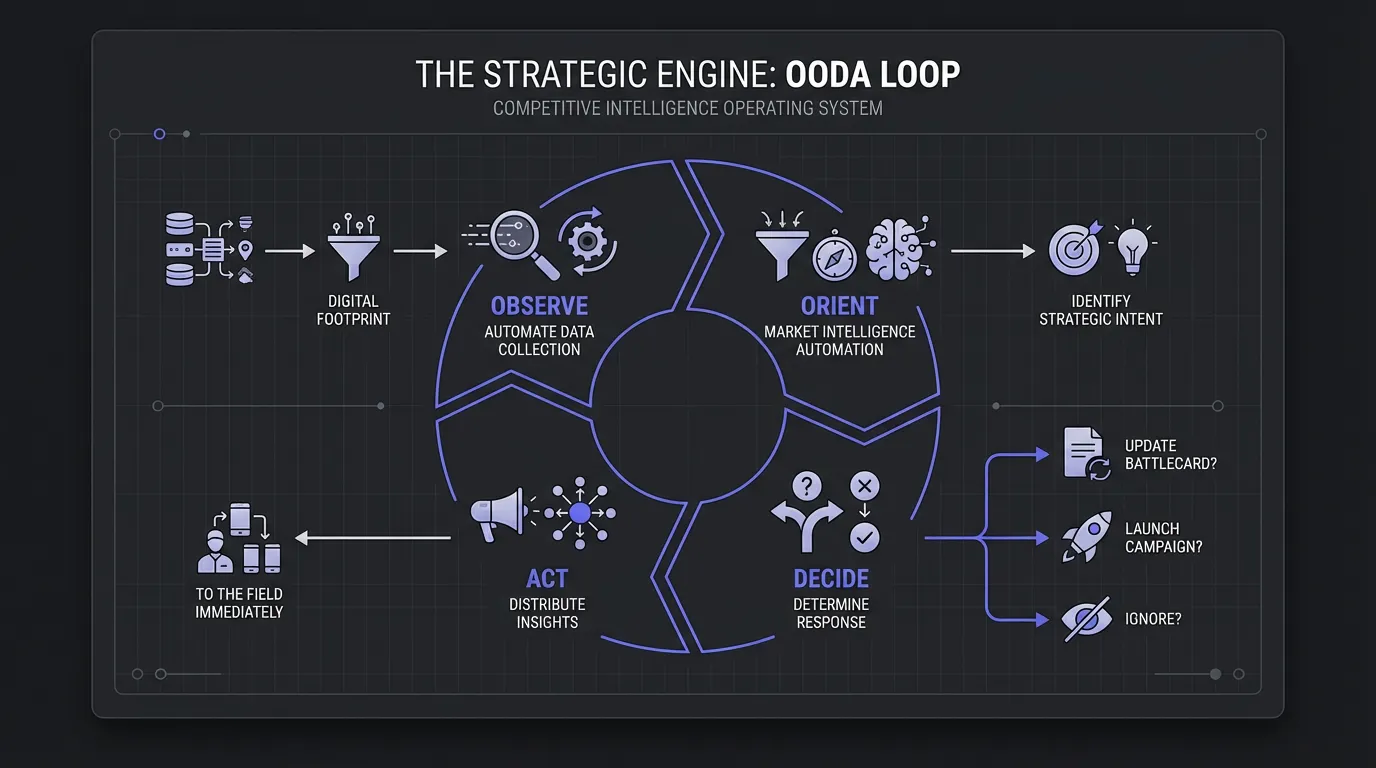

The Strategic Engine: The OODA Loop

Originally developed by military strategist John Boyd, the OODA Loop (Observe, Orient, Decide, Act) is the perfect operating system for a modern Competitive Intelligence Strategy.

- Observe: Automate the collection of raw data across the entire digital footprint.

- Orient: Use Market Intelligence Automation to filter noise and identify strategic intent.

- Decide: Determine the strategic response (Update battlecard? Launch campaign? Ignore?).

- Act: Distribute insights to the field immediately.

If you can cycle through this loop faster than your competitor, you win. Here is your 6-step guide to building this engine.

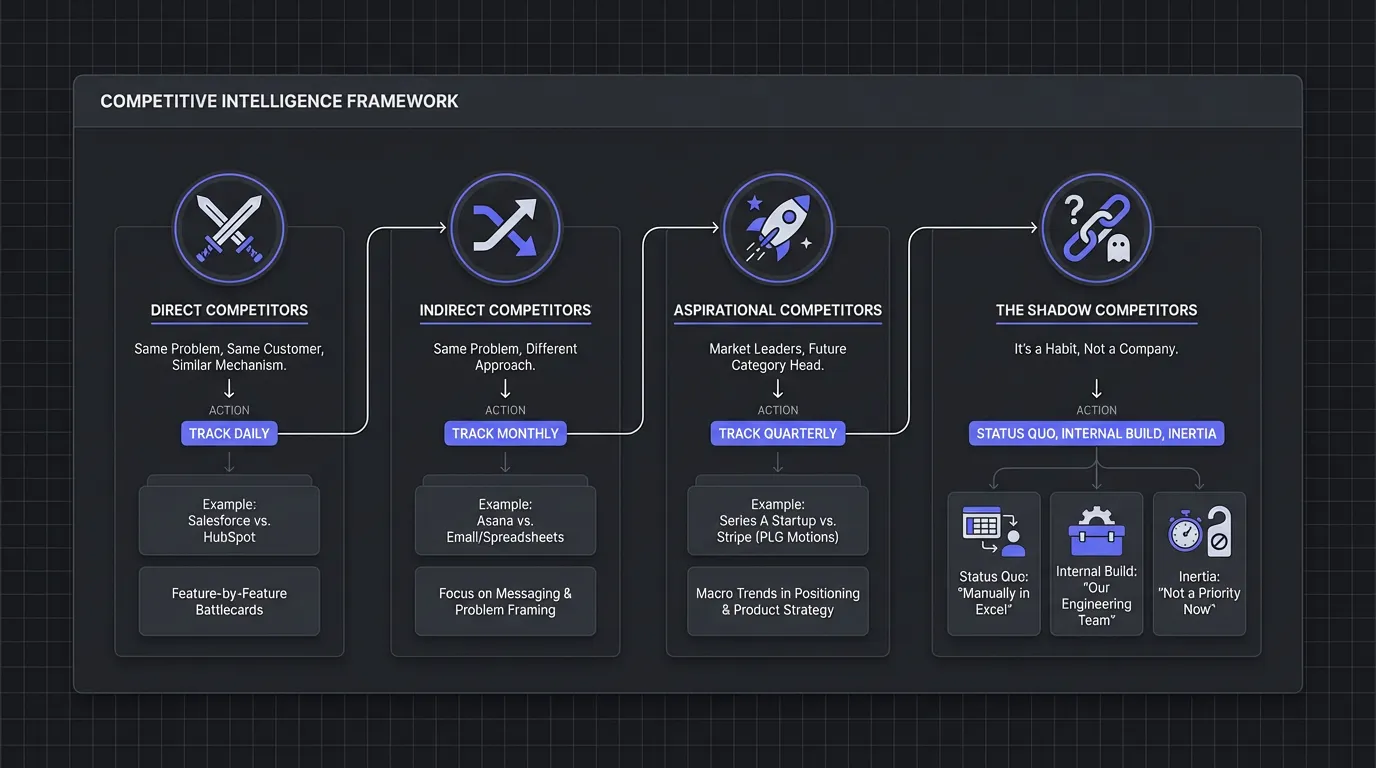

Step 1: Identify Your Competitive Landscape (Observe)

The first step in any Competitive Intelligence Strategy is expanding your aperture. Disruption rarely comes from the rival you obsess over; it comes from the blind spot.

After analyzing 500+ SaaS competitive landscapes, we've identified four categories you must track:

1. Direct Competitors

The obvious ones. Same problem, same customer, similar mechanism.

- Example: Salesforce vs. HubSpot.

- Action: Track daily. These require detailed feature-by-feature battlecards.

2. Indirect Competitors

Same problem, different approach. They compete for budget, not always the same line item.

- Example: Asana (Project Management) vs. Email/Spreadsheets.

- Action: Track monthly. Focus on their messaging—how are they framing the problem?

3. Aspirational Competitors

Market leaders you want to become. Tracking them reveals where your category is heading.

- Example: A Series A startup tracking Stripe's PLG motions.

- Action: Track quarterly. Look for macro trends in positioning and product strategy.

4. The Shadow Competitors

This is the category most CI strategies miss entirely. A shadow competitor isn't a company—it's a habit.

- The Status Quo: "We'll just keep doing it manually in Excel."

- Internal Build: "Our engineering team can build this."

- Inertia: "It's not a priority right now."

💡 Data Point: After analyzing 10,000+ "Closed Lost" records across our customer base, Lensmor found that Shadow Competitors account for 32% of lost revenue. If your "No Decision" rate exceeds 30%, your enemy isn't a rival SaaS—it's your own value proposition.

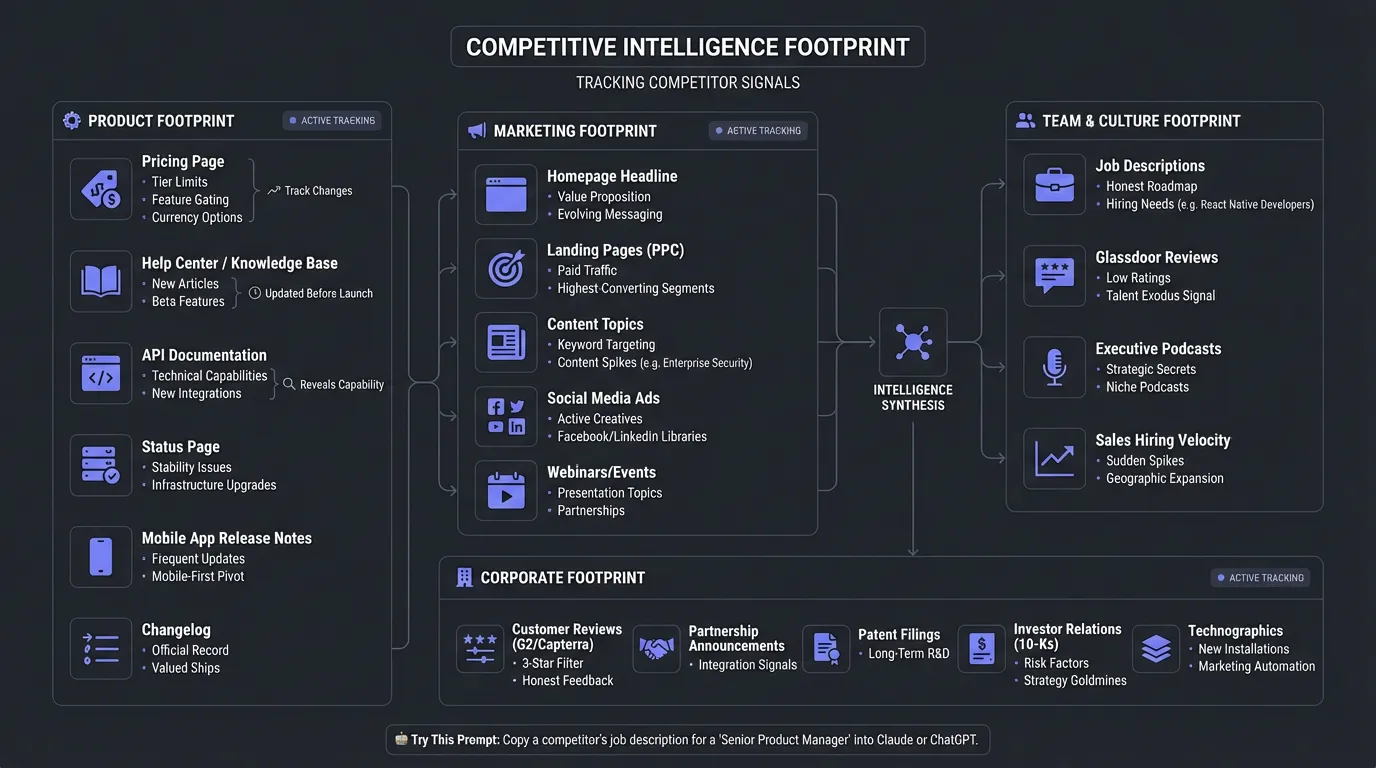

Step 2: Map the Digital Footprint (The 20-Point Checklist)

Once you know who to track, you need to define where to look. A competitor's digital footprint extends far beyond their homepage. In the AI era, every digital interaction leaves a trace.

Use this checklist to audit your current coverage.

📦 Product Footprint

- Pricing Page: Track changes in tier limits, feature gating, and currency options.

- Help Center / Knowledge Base: Often updated before marketing launches. Look for new articles on "Beta" features.

- API Documentation: Reveals technical capabilities and new integrations before they are announced.

- Status Page: Reveals stability issues or infrastructure upgrades.

- Mobile App Release Notes: Frequent updates here signal a mobile-first pivot.

- Changelog: The official record of what they value enough to ship.

📣 Marketing Footprint

- Homepage Headline: How is their value proposition evolving? (e.g., shifting from "Cheapest" to "Fastest").

- Landing Pages (PPC): Where are they sending paid traffic? This reveals their highest-converting segments.

- Content Topics: What keywords are they targeting in their blog? (e.g., a sudden spike in "Enterprise Security" content).

- Social Media Ads: Use Facebook/LinkedIn Ad Libraries to see active creatives.

- Webinars/Events: What topics are they presenting on? Who are they partnering with?

👥 Team & Culture Footprint

- Job Descriptions: The most honest roadmap. Hiring "React Native Developers"? Mobile app coming. Hiring "Federal Sales"? Government sector push.

- Glassdoor Reviews: Low ratings on "Management" might signal an exodus of talent.

- Executive Podcasts: CEOs often spill strategic secrets on niche podcasts that they wouldn't put in a press release.

- Sales Hiring Velocity: A sudden spike in SDR hiring in a specific region signals geographic expansion.

💰 Corporate Footprint

- Customer Reviews (G2/Capterra): Filter for 3-star reviews—that's where honesty lives.

- Partnership Announcements: Integration signals.

- Patent Filings: Long-term R&D direction.

- Investor Relations (10-Ks): Risk factors and strategy goldmines.

- Technographics: BuiltWith reveals new marketing automation or ABM tool installations.

🤖 Try This Prompt: Copy a competitor's job description for a "Senior Product Manager" into Claude or ChatGPT.

Prompt: "Analyze this job description. Based on the responsibilities and required skills, predict what specific product features or strategic initiatives this company is planning to build in the next 6-12 months."Step 3: Automate Collection with AI (Orient)

Here's where most companies go wrong: they think automation means "more alerts."

Wrong. Market Intelligence Automation means smarter collection, not more collection. It means using technology to orient yourself in the chaos.

The Three Technologies That Actually Work

1. Visual Change Detection (Computer Vision)

Old tools flagged every code change. Modern AI "looks" at the page like a human, ignoring code refactoring and only alerting on visible changes—like a price moving from $10 to $20, or a logo changing.

2. NLP for Sentiment Analysis

You cannot read 5,000 G2 reviews manually. AI Competitive Analysis tools scan them to say: "Competitor X's sentiment for 'Customer Support' dropped by 15% this quarter, with 'Slow Response' being the top keyword."

3. Predictive Modeling & Anomaly Detection

Instead of watching daily, let AI establish a baseline and alert you only when deviations occur (e.g., a massive spike in hiring).

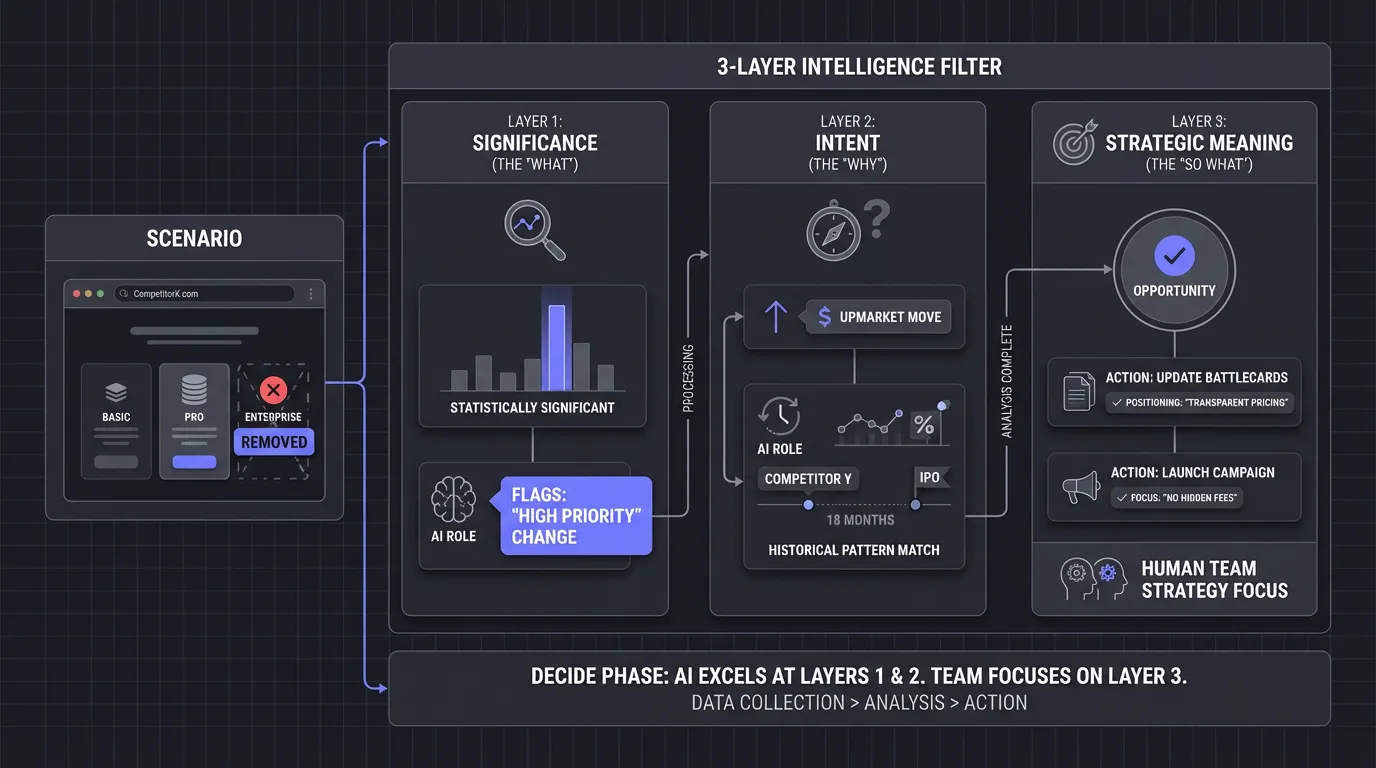

Step 4: The 3 Layers of Analysis (Decide)

Data collection without analysis is just hoarding. This is the "Decide" phase of the OODA Loop. Use this 3-layer filter to process incoming intelligence.

Scenario: Competitor X suddenly removes their "Enterprise" pricing tier from their public website.

Layer 1: Significance (The "What")

- Question: Is this significant or noise?

- Analysis: An entire pricing tier disappeared. Statistically significant.

- AI Role: Flags as "High Priority" change on a money-page.

Layer 2: Intent (The "Why")

- Question: What's the strategic intent?

- Analysis: Removing public pricing signals a move upmarket to value-based pricing.

- AI Role: Cross-references historical patterns: "Competitor Y did this 18 months before IPO."

Layer 3: Strategic Meaning (The "So What")

- Question: What does this mean for us?

- Analysis: Prospects frustrated by lack of transparency present an opportunity.

- Action: Update battlecards for "Transparent Pricing" positioning. Launch "No Hidden Fees" campaign.

AI excels at Layers 1 and 2. Your team focuses on Layer 3—where strategy happens.

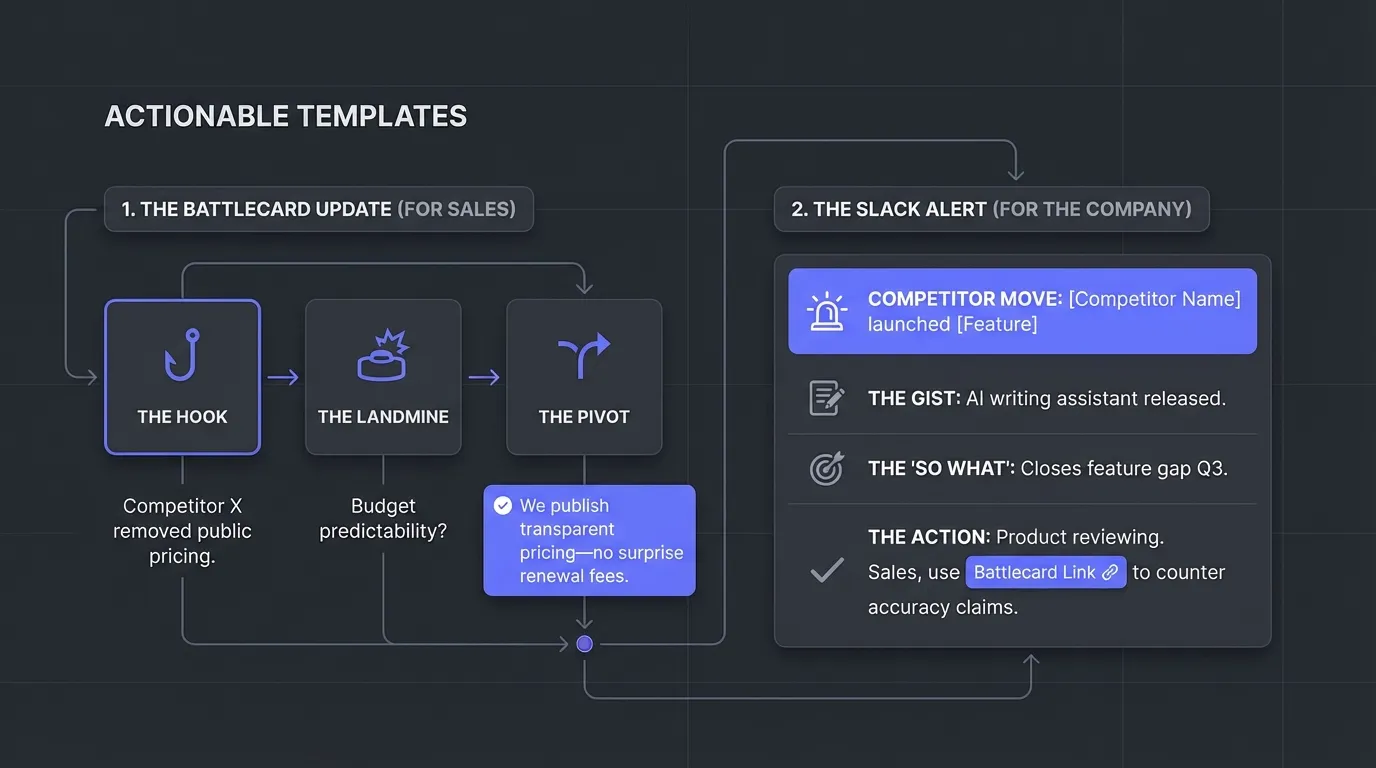

Step 5: Distribute Insights (Act)

The goal of a Competitive Intelligence Strategy is action, not archiving. Dead intelligence lives in static PDFs. Live intelligence drives revenue.

The Distribution Model

Actionable Templates

1. The Battlecard Update (For Sales)

Use the "Hook-Landmine-Pivot" framework:

- The Hook: "Did you know Competitor X just removed their public pricing?"

- The Landmine: "How important is budget predictability to your procurement team?"

- The Pivot: "Unlike them, we publish transparent pricing—no surprise renewal fees."

2. The Slack Alert (For the Company)

- 🚨 COMPETITOR MOVE: [Competitor Name] launched [Feature]

- 📝 The Gist: They released an AI writing assistant today.

- 🎯 The "So What": This closes the feature gap we identified in Q3.

- ✅ The Action: Product reviewing. Sales, use [Battlecard Link] to counter accuracy claims.

Step 6: Measure Success (The Loop)

If you don't measure it, you're just guessing. Measuring CI ROI requires both quantitative and qualitative metrics.

Quantitative ROI

- Win Rate Improvement: Compare win rates in deals where battlecards were viewed vs. not viewed. (Lensmor typically sees a 15% delta).

- Revenue Attribution: Tag closed-won opportunities where specific CI insights influenced the outcome.

- Sales Cycle Velocity: Does knowing the competitor's weak spot help reps close faster?

Qualitative ROI

- Sales Confidence Score: Quarterly survey: "Scale 1-10, how confident do you feel facing Competitor X?" Track the trend.

- Stakeholder Engagement: Are PMs reading your analysis? Are execs quoting your findings in board meetings?

Avoid the False Positive Trap

Alert fatigue kills CI programs. If you send 50 alerts a day, sales will block you.

- Fix: Use intent recognition to filter out the 95% of changes that don't matter (typos, minor CSS changes).

Conclusion: The Action Plan

Building a Competitive Intelligence Strategy fueled by AI Competitive Analysis is no longer optional—it's survival. Remember: Intelligence is perishable. Act fast or it rots.

Here's your immediate action plan:

- This Week: Audit your competitive landscape using the 4-category framework. Identify your Shadow Competitors.

- This Month: Implement the 20-point Digital Footprint checklist. Start with Product and Marketing footprints.

- This Quarter: Deploy Market Intelligence Automation with intent recognition.

- Ongoing: Distribute insights using the battlecard templates. Measure win rate impact.

The result? You stop reacting to the market and start leading it.

Frequently Asked Questions (FAQs)

Q: How does AI improve competitive intelligence compared to traditional methods?

A: Traditional CI is manual and retrospective. AI Competitive Analysis automates collection across thousands of sources and uses NLP to extract meaning from unstructured data. It reduces time-to-insight from weeks to hours and eliminates false positives, allowing for real-time strategic decisions via the OODA Loop.

Q: What is the difference between direct, indirect, and shadow competitors?

A: Direct competitors offer similar solutions (Salesforce vs. HubSpot). Indirect competitors solve the same problem differently (Asana vs. Email). Shadow competitors are non-commercial alternatives like "doing nothing" or "building internally." Our data shows Shadow Competitors account for 30%+ of lost deals.

Q: What is the minimum budget needed to implement AI-powered competitive intelligence?

A: A DIY approach (Visualping + Zapier + OpenAI) costs ~$90-150/month. Mid-market platforms (Crayon, Klue) range from $15k-50k/year. Lensmor fills the gap for Growth SaaS with intelligent automation at an accessible price point.

Q: How do I measure the ROI of competitive intelligence?

A: Track Quantitative ROI (Win rates in battlecard-assisted deals, revenue attribution) and Qualitative ROI (Sales Confidence Scores, stakeholder engagement). If your intelligence isn't reducing sales cycles or improving win rates, your distribution model needs work.

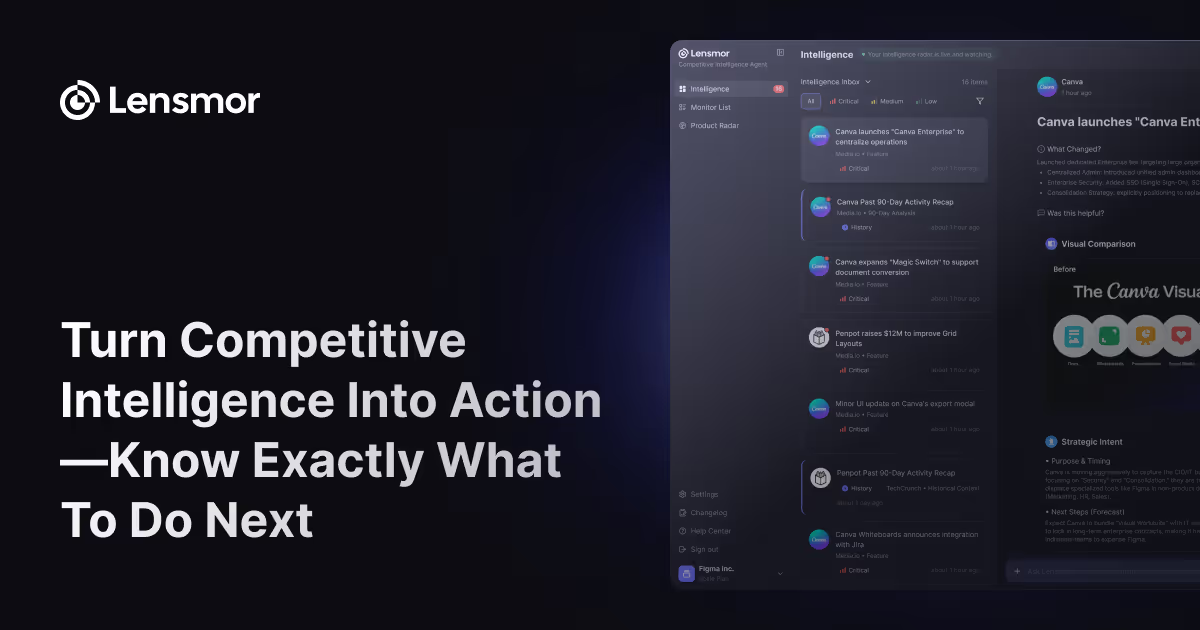

🚀 Coming Soon: The CI Agent for Growth SaaS

Stop settling for tools that are either too simple (pixel watchers) or too expensive (enterprise platforms at $30k/year).

We're building Lensmor—the intelligent CI Agent designed specifically for Growth SaaS companies.

What makes Lensmor different:

Intent Recognition: We don't alert on pixel changes. We tell you what changes mean.

Action Plans: Every insight comes with a recommended response.

Growth-Stage Pricing: Enterprise intelligence without the enterprise price tag.

🔥 Limited Time Pre-Launch Offer: Join our Waitlist now to secure 50% OFF your subscription and get a Free Backlink when we go live.