Your competitor just shipped a feature that directly addresses your prospects' #1 objection. You found out from a customer who's now evaluating them. By the time your product team prioritizes a response, three more deals are lost. This isn't bad luck—it's a speed problem. And in SaaS, the fast eat the slow.

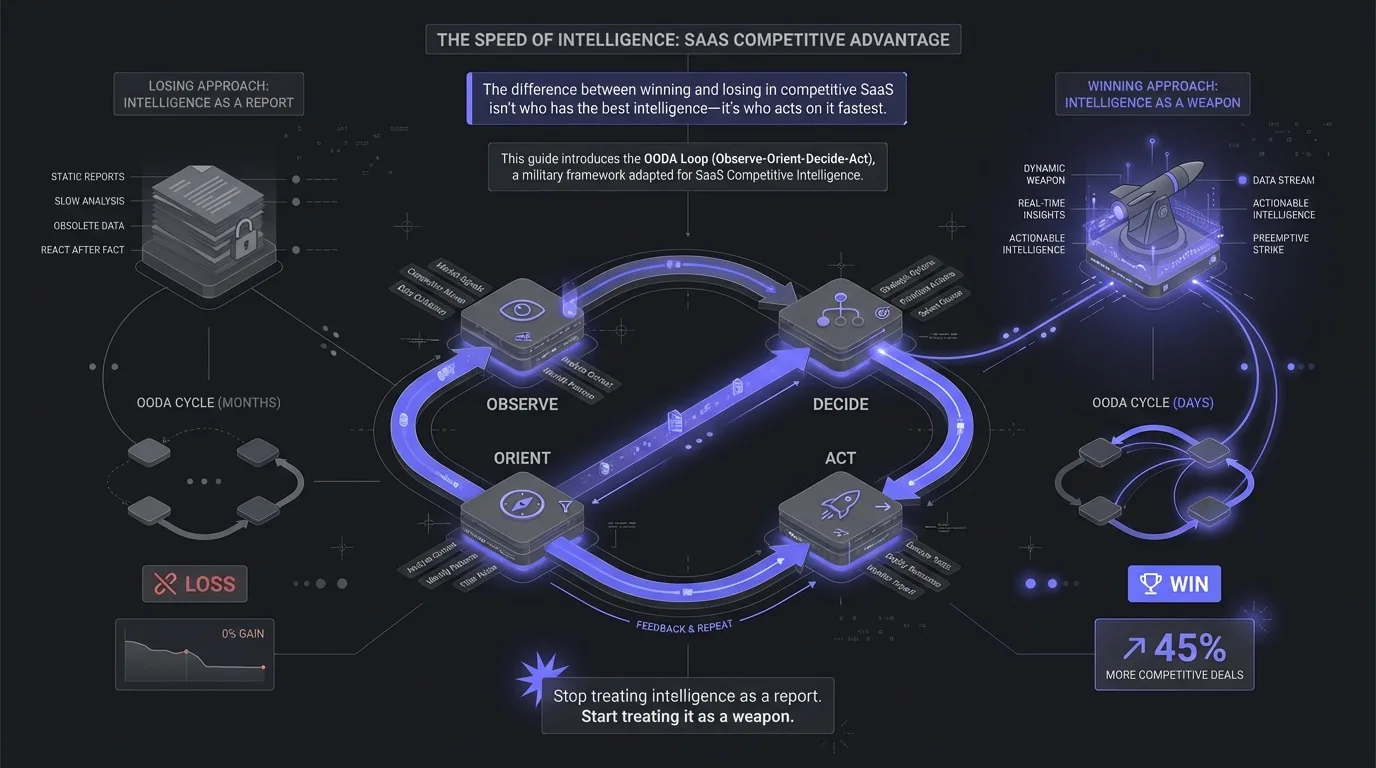

TL;DR: The difference between winning and losing in competitive SaaS isn't who has the best intelligence—it's who acts on it fastest. This guide introduces the OODA Loop (Observe-Orient-Decide-Act), a military framework adapted for SaaS Competitive Intelligence. Companies that complete their OODA cycle in days instead of months win 45% more competitive deals. Stop treating intelligence as a report. Start treating it as a weapon.

Here's what most SaaS companies get wrong: they think Competitive Intelligence is about gathering data. It's not. Data sitting in a spreadsheet is worthless. Intelligence only matters when it changes what you do—and how fast you do it.

The OODA Loop was developed by military strategist John Boyd to explain why some fighter pilots consistently won dogfights. His insight was simple but profound: the pilot who cycles through Observe-Orient-Decide-Act faster than their opponent will always win, even with inferior equipment.

In SaaS, your competitors are the enemy pilots. The market is the battlefield. And your OODA cycle speed determines whether you win or get shot down.

The Old Way: Linear Intelligence That's Dead on Arrival

Let's be honest about how most SaaS companies do competitive intelligence today.

The Quarterly Report: Someone compiles a 40-page competitive analysis. By the time it's reviewed, approved, and distributed, half the information is outdated. Competitors don't wait for your fiscal calendar.

The Pixel-Monitoring Trap: Tools like Visualping alert you to every change—a footer update, a stock photo swap, a cookie banner tweak. After 200 false alarms, your team ignores every notification. The one that matters (a 40% price drop) gets buried.

The Research-to-Action Gap: Even when you spot something important, there's no system to turn it into action. Intel goes into a Slack channel. Someone says "interesting." Nothing changes. Deals keep getting lost.

Lensmor analyzed 500+ SaaS companies' CI processes and found: the average time from "competitor signal detected" to "organizational response executed" is 47 days. Your competitors are cycling faster than that. You're losing before you even know you're in a fight.

The New Way: The OODA Loop for Agile Intelligence

The OODA Loop transforms competitive intelligence from a passive research function into an active competitive weapon. Here's how it works for SaaS:

The key insight: it's not about doing each phase perfectly—it's about cycling through all four phases faster than your competitors. A 70% solution executed immediately beats a 100% solution delivered too late.

For a deeper dive on maturity levels, see The SaaS Competitive Maturity Model: Are You an Ostrich or a Strategist?

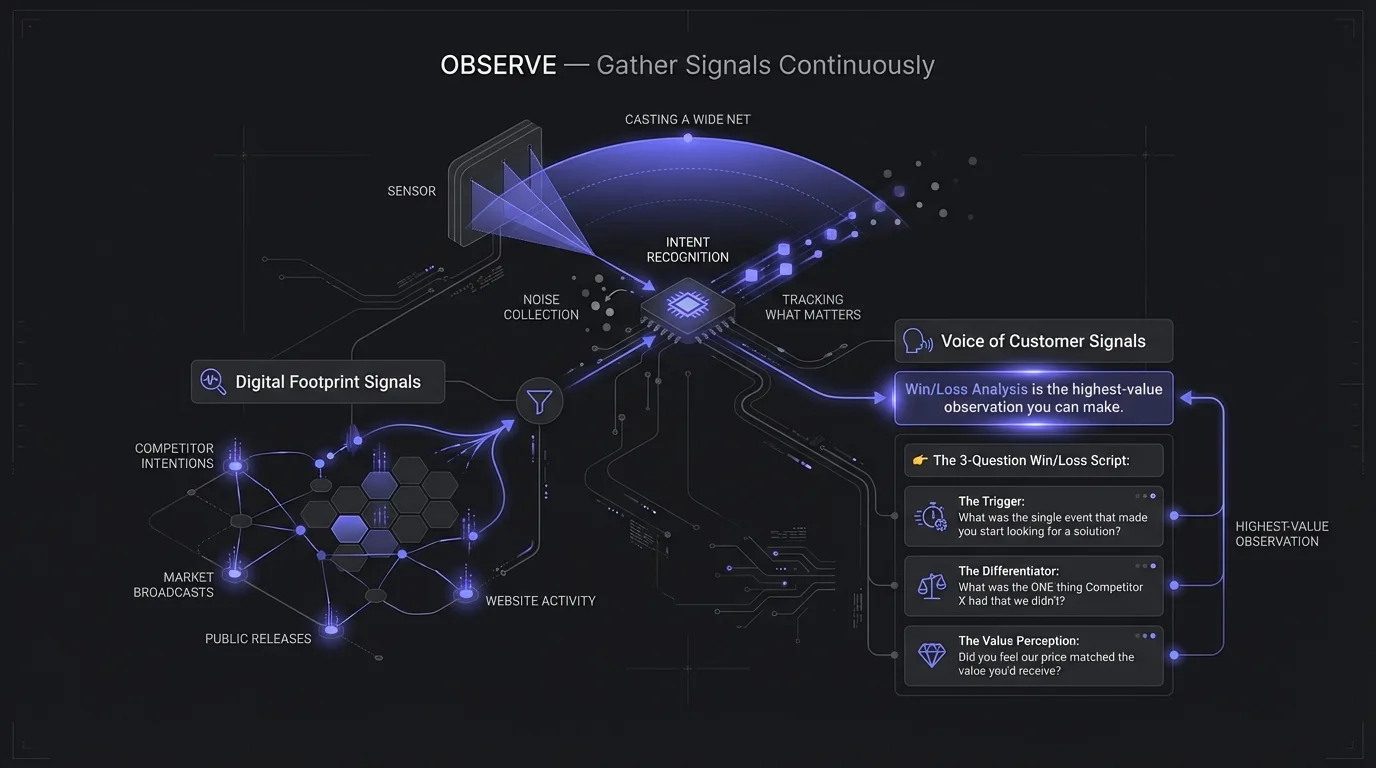

Step 1: OBSERVE — Gather Signals Continuously

OBSERVE is about casting a wide net to capture signals—but with intent recognition, not noise collection. You're not tracking everything; you're tracking what matters.

Digital Footprint Signals

Your competitors broadcast their intentions constantly. You just need to know where to look.

Voice of Customer Signals

Win/Loss Analysis is the highest-value observation you can make. When you lose a deal, that prospect just completed an evaluation you'd pay thousands for.

👉 The 3-Question Win/Loss Script:

- The Trigger: "What was the single event that made you start looking for a solution?"

- The Differentiator: "What was the ONE thing Competitor X had that we didn't?"

- The Value Perception: "Did you feel our price matched the value you'd receive?"

For more real-world examples of competitive intelligence in action, see 7 Real-World Competitive Counter-Moves.

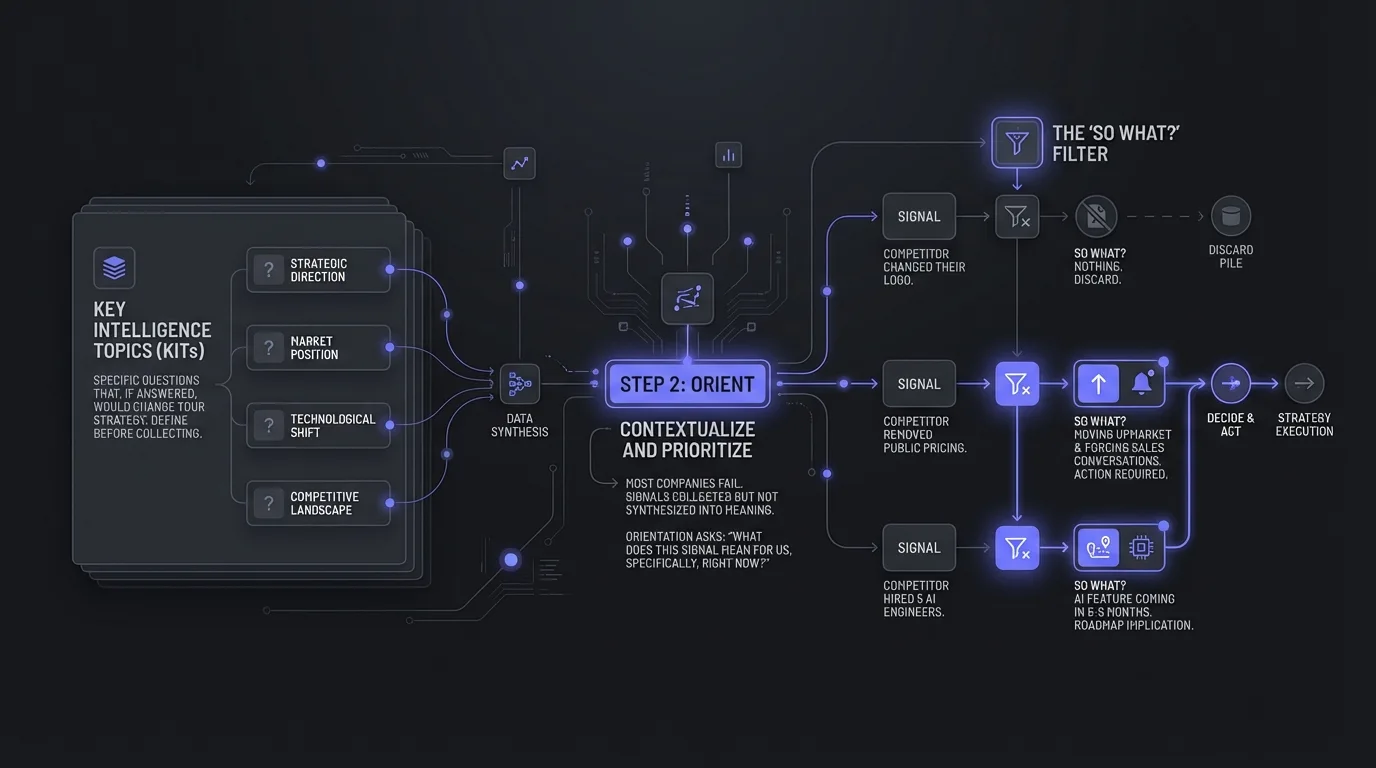

Step 2: ORIENT — Contextualize and Prioritize

ORIENT is where most companies fail. They collect signals but never synthesize them into meaning. Orientation is about asking: "What does this signal mean for us, specifically, right now?"

Define Your Key Intelligence Topics (KITs)

Not all intelligence is equal. KITs are the specific questions that, if answered, would change your strategy. Define these BEFORE you start collecting.

The "So What?" Filter

Before any signal advances to DECIDE, it must pass the "So What?" test:

- Competitor changed their logo. → So what? Nothing. Discard.

- Competitor removed public pricing. → So what? They're moving upmarket and forcing sales conversations. Action required.

- Competitor hired 5 AI engineers. → So what? AI feature coming in 6-9 months. Roadmap implication.

For frameworks on avoiding the feature-matching trap, read Why Copying Competitors Will Kill Your Startup.

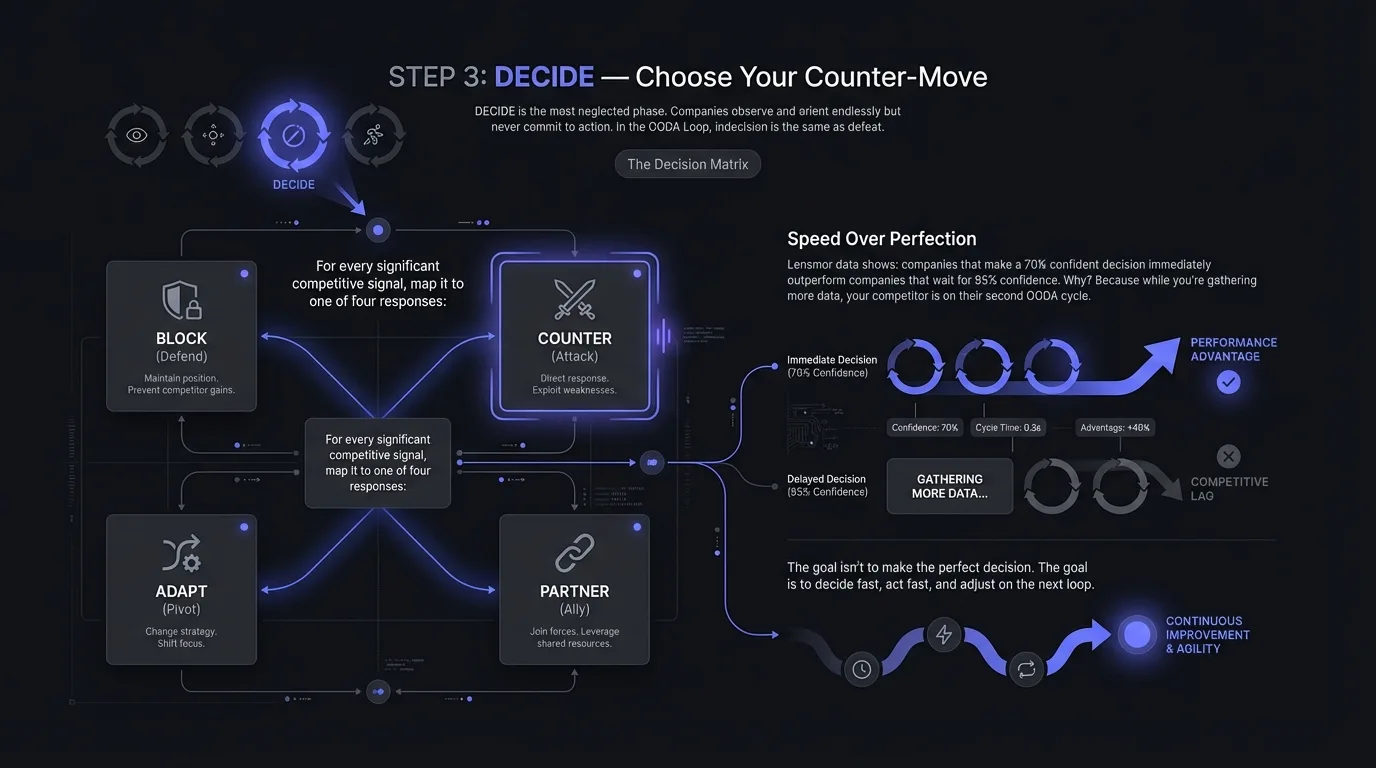

Step 3: DECIDE — Choose Your Counter-Move

DECIDE is the most neglected phase. Companies observe and orient endlessly but never commit to action. In the OODA Loop, indecision is the same as defeat.

The Decision Matrix

For every significant competitive signal, map it to one of four responses:

Speed Over Perfection

Lensmor data shows: companies that make a 70% confident decision immediately outperform companies that wait for 95% confidence. Why? Because while you're gathering more data, your competitor is on their second OODA cycle.

The goal isn't to make the perfect decision. The goal is to decide fast, act fast, and adjust on the next loop.

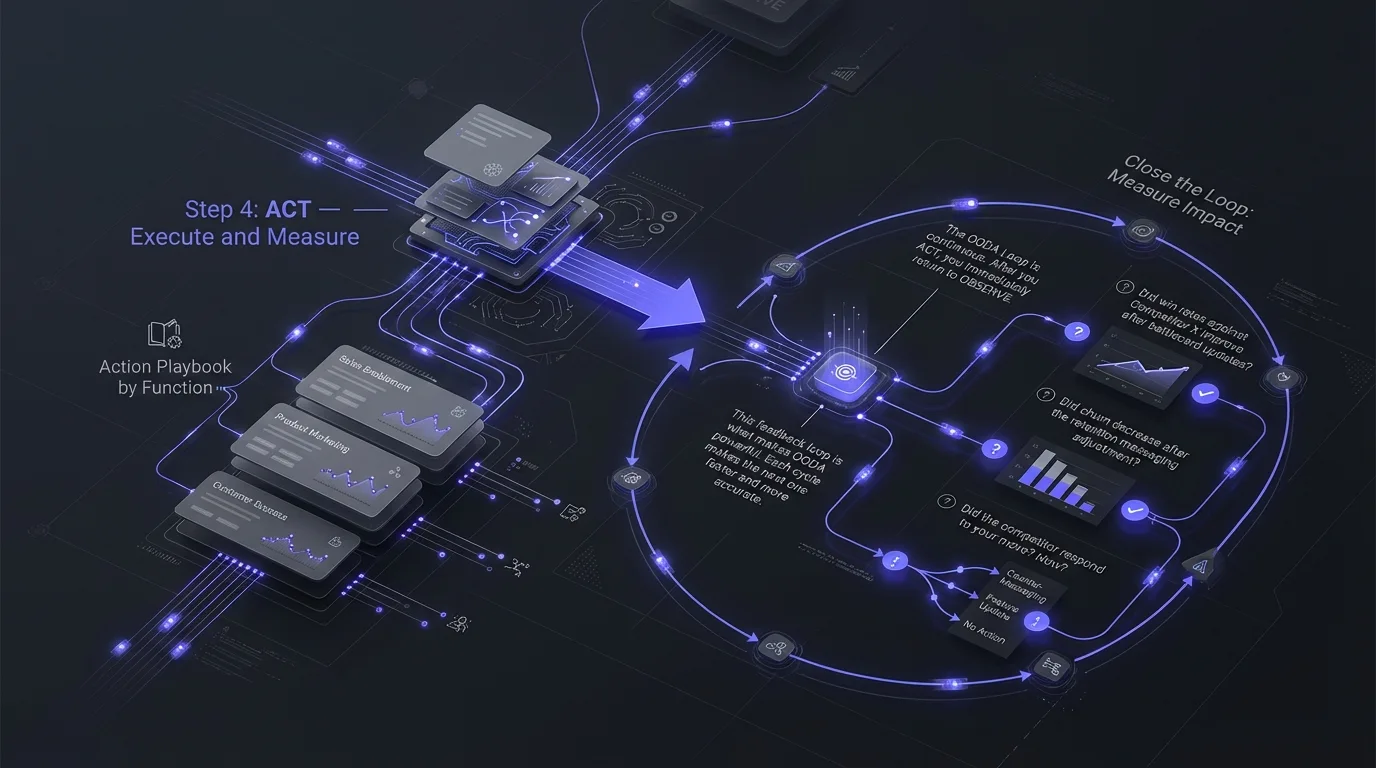

Step 4: ACT — Execute and Measure

ACT is where intelligence becomes advantage. A decision without execution is just an opinion.

Action Playbook by Function

Close the Loop: Measure Impact

The OODA Loop is continuous. After you ACT, you immediately return to OBSERVE—but now you're observing the impact of your action.

- Did win rates against Competitor X improve after battlecard updates?

- Did churn decrease after the retention messaging adjustment?

- Did the competitor respond to your move? How?

This feedback loop is what makes OODA powerful. Each cycle makes the next one faster and more accurate.

For strategic frameworks on market positioning, see The Age of Agile Intelligence.

How to Shorten Your OODA Cycle

The company with the fastest OODA cycle wins. Here's how to accelerate yours:

Cycle Speed Comparison

Three Tactics to Accelerate

- Automate OBSERVE: Use tools like the best competitive intelligence tools for SaaS to eliminate manual monitoring.

- Pre-define DECIDE: Create decision trees in advance. "If competitor drops price >20%, we respond with X."

- Empower ACT: Give your CI owner authority to push battlecard updates without committee approval.

🚀 Accelerate Your OODA Loop with Lensmor

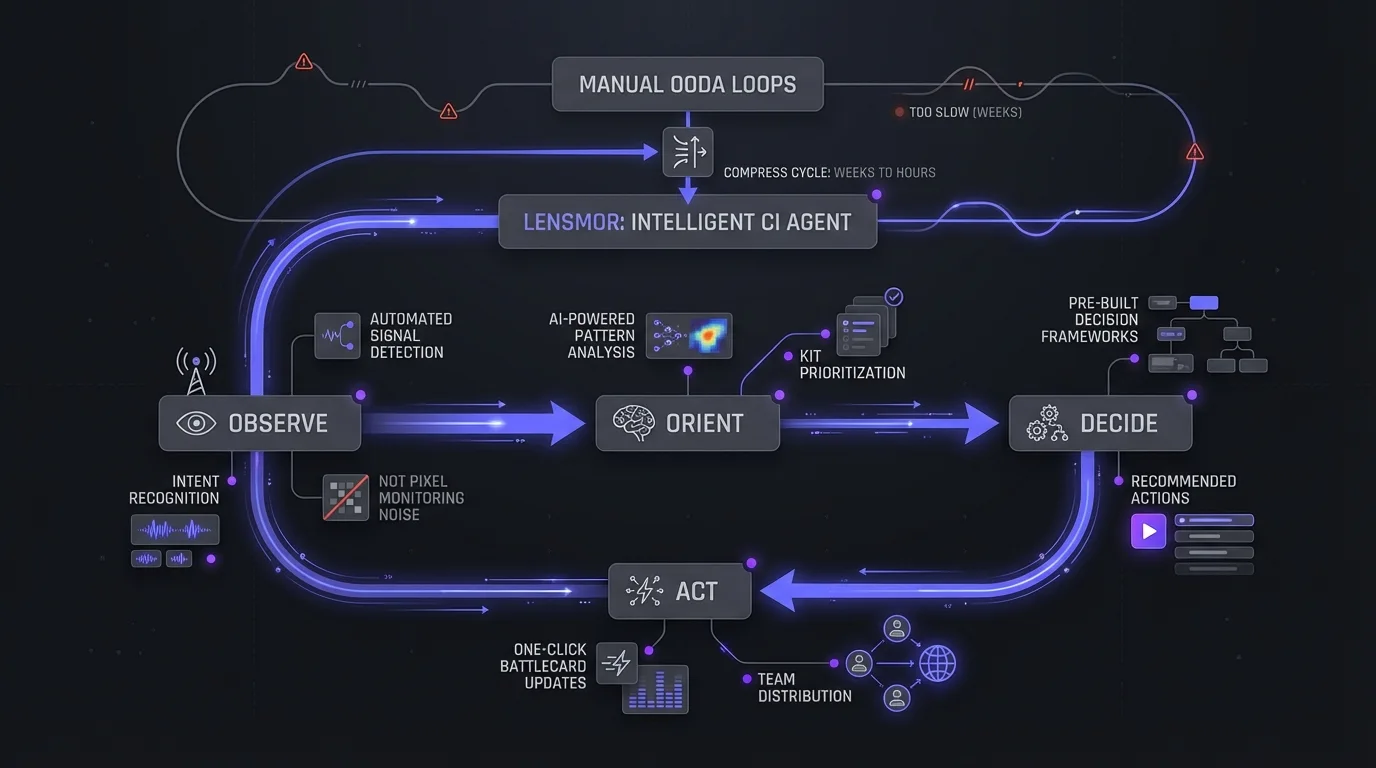

Manual OODA loops are better than no loops—but they're still too slow. Lensmor is the intelligent CI Agent built to compress your cycle from weeks to hours.

- OBSERVE: Automated signal detection with intent recognition (not pixel monitoring noise)

- ORIENT: AI-powered pattern analysis and KIT prioritization

- DECIDE: Pre-built decision frameworks and recommended actions

- ACT: One-click battlecard updates and team distribution

Stop losing deals because your competitors cycle faster. Start outmaneuvering them.

🔥 Limited Time Pre-Launch Offer:Join our Waitlist now to secure 50% OFF your subscription and a Free Backlink when we go live.

Conclusion: Speed Wins

The OODA Loop isn't just a framework—it's a competitive philosophy. In SaaS, you're not competing on features or price alone. You're competing on speed of adaptation.

The company that observes market signals first, orients them correctly, decides without paralysis, and acts immediately will always outmaneuver the company that does better analysis but moves slower.

Your competitors are cycling right now. How fast is your loop?

For more on building organizational CI capability, explore The 2025 Market Intelligence Stack. And remember: follow ethical intelligence guidelines in all your competitive activities.

Frequently Asked Questions (FAQs)

Q: What is the OODA Loop and why does it matter for SaaS?

A: The OODA Loop (Observe-Orient-Decide-Act) is a decision-making framework developed by military strategist John Boyd. In SaaS, it transforms competitive intelligence from passive research into active competitive advantage. The core insight is that the company cycling through all four phases fastest—not the one with the most data—wins competitive deals. Lensmor's analysis of 500+ SaaS companies shows that reducing your OODA cycle from 60 days to 7 days correlates with a 45% improvement in competitive win rates. The framework forces you to move from "gathering intelligence" to "acting on intelligence" systematically.

Q: How is the OODA Loop different from traditional competitive intelligence?

A: Traditional CI is linear: research competitors, write a report, share it, move on. The OODA Loop is continuous and cyclical. After you ACT, you immediately return to OBSERVE—now watching the impact of your action and your competitor's response. This creates a feedback loop that makes each cycle faster and more accurate. Traditional CI asks "what are competitors doing?" OODA asks "how fast can we respond and what happens next?" The speed advantage compounds over time.

Q: How long should one OODA cycle take for a SaaS company?

A: For tactical moves (competitor pricing changes, feature launches), target a 3-7 day full cycle. For strategic shifts (market repositioning, major product pivots), 2-4 weeks is acceptable. The key metric isn't absolute speed—it's relative speed versus your competitors. If they're cycling in months and you're cycling in weeks, you win. Most SaaS companies today operate on 60-90 day cycles, which means even modest improvements create significant advantage.

Q: What tools are needed to implement the OODA Loop effectively?

A: At minimum, you need: (1) automated monitoring for OBSERVE (website change trackers, review aggregators), (2) a centralized analysis space for ORIENT (can be as simple as Notion), (3) decision documentation for DECIDE (pre-built playbooks), and (4) distribution channels for ACT (Slack integrations, CRM-embedded battlecards). The goal is reducing manual effort so your team focuses on analysis and action, not data gathering. For a comprehensive toolkit.

Q: How do I get executive buy-in for implementing OODA-based CI?

A: Tie it to revenue. Calculate how many competitive deals you lost last quarter and their total ACV. Present OODA as a system to recover 15-30% of those losses through faster response times. Executives don't care about frameworks—they care about win rates and ARR. Frame OODA not as "a new process" but as "a system to stop leaving revenue on the table." Show them the 47-day average response time stat and ask if they think competitors are waiting that long.