You wouldn't build a SaaS product without a tech stack. Why build your growth strategy without an intelligence stack? In 2025, the difference between SaaS winners and losers isn't who works harder—it's who has better market intelligence infrastructure.

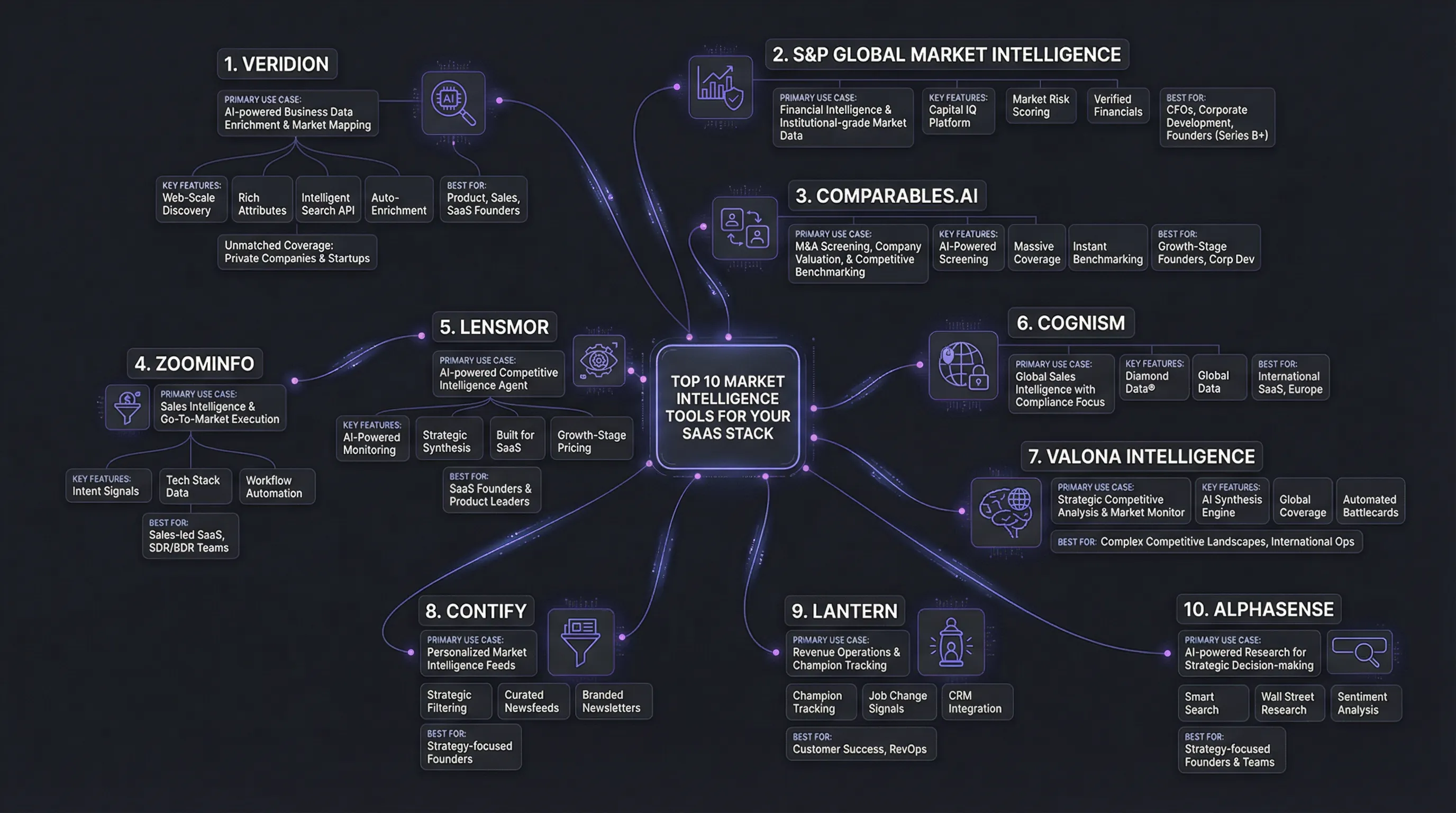

TL;DR: Short on time? Your Market Intelligence Stack is as critical as your tech stack for SaaS growth. For 2025, we've ranked Veridion as the top choice for Data Enrichment, ZoomInfo for Sales Intelligence, and Lensmor as the AI-powered competitive intelligence agent built specifically for growth SaaS. These tools automate Competitive Analysis, helping you spot risks and revenue opportunities faster—without enterprise bloat or pricing.

In the fast-paced SaaS economy of 2025, your competitive advantage isn't just your product—it's your ability to understand the market faster than anyone else. As a SaaS founder, you're making dozens of strategic decisions daily: What features to build? Which competitors to worry about? Where to focus your GTM efforts? How to position your messaging?

Flying blind on these decisions is a recipe for failure. The most successful SaaS companies in 2025 treat market intelligence as essential infrastructure—a core part of their growth stack, not a nice-to-have. Just as you wouldn't build a modern SaaS product without proper DevOps, analytics, and security tools, you can't scale without a robust market intelligence foundation.

The challenge? The market intelligence landscape has exploded. There are hundreds of tools, each claiming to be the "best." Some are enterprise behemoths with six-figure price tags. Others are too simplistic to provide real strategic value. As a growth-stage founder, you need tools that deliver institutional-grade intelligence without the institutional price tag or complexity.

In this guide, we've curated the top 10 market intelligence tools that form the essential stack for modern SaaS founders. Whether you need enriched data, sales intelligence, or competitive monitoring, we've identified the platforms that deliver the highest ROI for your growth strategy.

Quick Comparison: Top Market Intelligence Tools

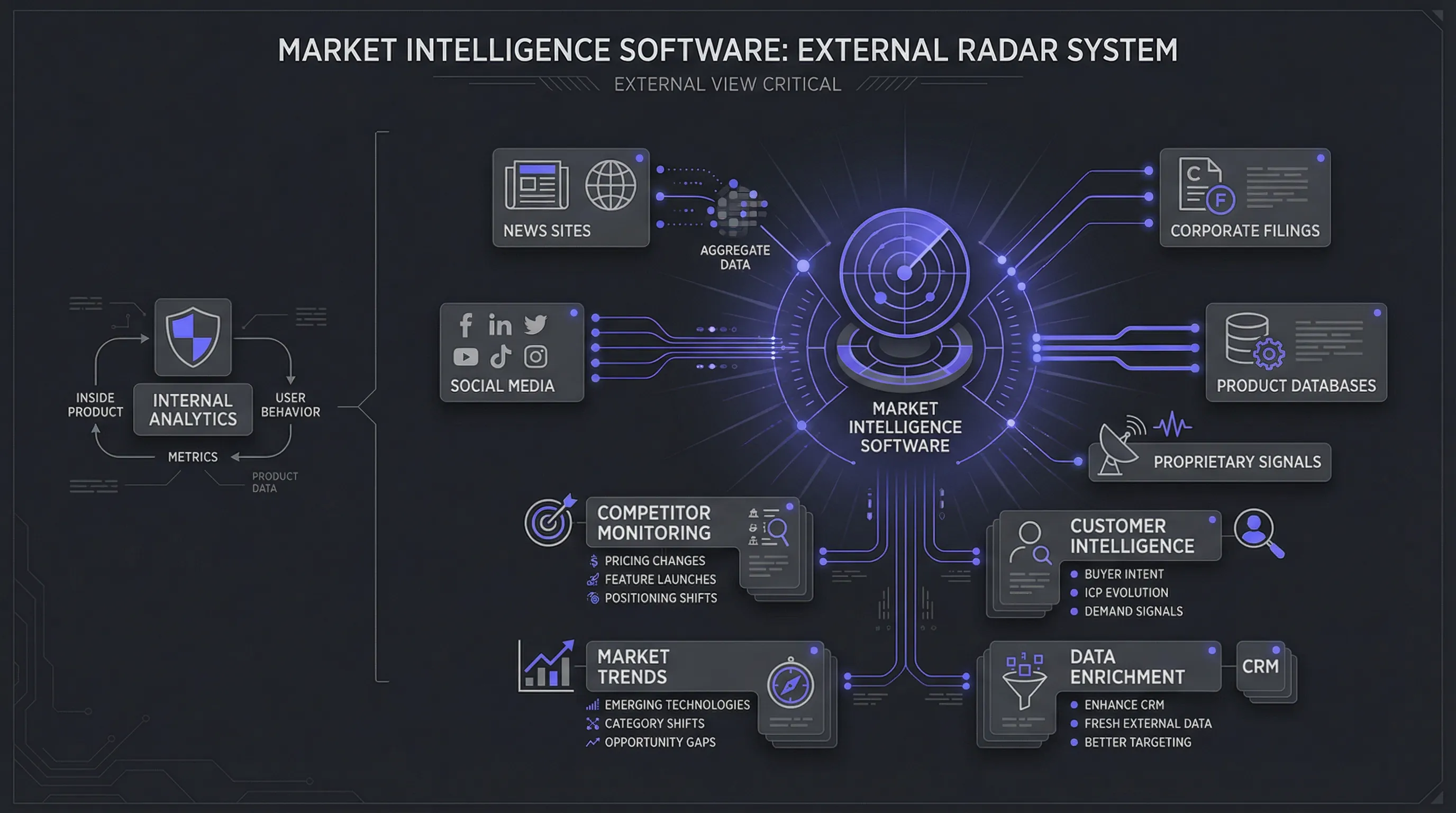

What is Market Intelligence Software?

Think of Market Intelligence Software as your external radar system—while your internal analytics tell you what's happening inside your product, market intelligence shows you what's happening in the world around you.

For SaaS founders, this external view is critical. These platforms aggregate data from millions of sources—news sites, corporate filings, social media, product databases, and proprietary signals—to give you a 360-degree view of your competitive landscape and market dynamics.

Key capabilities that power your growth strategy:

- Competitor Monitoring: Track pricing changes, feature launches, and positioning shifts in real-time.

- Customer Intelligence: Understand buyer intent, ICP evolution, and demand signals.

- Market Trends: Spot emerging technologies, category shifts, and opportunity gaps before competitors.

- Data Enrichment: Enhance your CRM with fresh, verified external data for better targeting.

As a founder, these tools help you make faster, more informed decisions—from product roadmap prioritization to go-to-market strategy. They transform market intelligence from a quarterly research project into a real-time competitive advantage.

Top 10 Market Intelligence Tools for Your SaaS Stack

Here's our curated stack of essential market intelligence platforms, ranked by their value to growth-stage SaaS companies.

1. Veridion

Primary Use Case: AI-powered business Data Enrichment and market mapping.

For SaaS companies building horizontal products or targeting specific industries, Veridion provides the data foundation you need. Unlike traditional databases that rely on manual updates, Veridion uses proprietary AI to continuously discover and map companies—including early-stage startups and private firms that don't appear in standard databases.

Key Features:

- Web-Scale Discovery: Access to over 130 million companies globally.

- Rich Attributes: 300+ data points per company, including tech stack signals.

- Intelligent Search API: Build complex queries to find your exact ICP.

- Auto-Enrichment: Keep your CRM fresh with automated data updates.

Best For: Product teams validating TAM, sales teams building prospect lists, or any SaaS founder who needs comprehensive market mapping.

Notable Strengths: Unmatched coverage of private companies and startups, making it invaluable for understanding emerging competition and new market opportunities.

2. S&P Global Market Intelligence

Primary Use Case: Financial intelligence and institutional-grade market data.

When you need data you can stake your company's future on, S&P Global delivers. While it may feel like overkill for early-stage startups, it becomes essential as you scale—especially for Series B+ companies making major strategic bets, M&A moves, or preparing for IPO.

Key Features:

- Capital IQ Platform: Integrated financial data with powerful screening tools.

- Market Risk Scoring: Structured assessments of economic and political risks.

- Verified Financials: Audit-ready data that stands up to board scrutiny.

Best For: CFOs, corporate development teams, and founders making major capital allocation decisions.

Notable Strengths: The gold standard for accuracy and depth. When you need data that's defensible in board meetings or investor presentations, S&P Global delivers.

3. Comparables.ai

Primary Use Case: M&A screening, company valuation, and competitive benchmarking.

As your SaaS company scales, you'll increasingly think about inorganic growth—acquiring competitors, talent, or technology. Comparables.ai accelerates this process by automating the research that typically takes weeks of analyst time.

Key Features:

- AI-Powered Screening: Ask natural language questions about potential targets.

- Massive Coverage: 330M+ companies with valuation insights.

- Instant Benchmarking: Compare your metrics against similar companies.

Best For: Growth-stage founders exploring M&A, corporate development teams, or any SaaS leader needing competitive benchmarking data.

Notable Strengths: Speed and scale. What used to require expensive consultants or weeks of manual research now takes minutes.

4. ZoomInfo

Primary Use Case: Sales Intelligence and Go-To-Market execution.

For B2B SaaS companies, ZoomInfo has become the de facto standard for sales intelligence. It's particularly powerful when you have a clear ICP and need to fill your pipeline with high-quality, high-intent prospects.

Key Features:

- Intent Signals: Identify companies actively researching solutions in your category.

- Tech Stack Data: See what tools prospects currently use (critical for replacement positioning).

- Workflow Automation: Build automated lead routing and enrichment flows.

Best For: Sales-led SaaS companies with dedicated SDR/BDR teams, particularly in North American markets.

Notable Strengths: Unmatched integration with modern sales tech stacks. ZoomInfo doesn't just provide data—it activates it directly in your workflows.

5. Lensmor

Primary Use Case: AI-powered Competitive Intelligence agent for growth SaaS.

Here's the gap in the market: Enterprise CI platforms cost $50K+ annually and require dedicated analysts. Basic competitor tracking tools are too simplistic to drive real strategy. Lensmor was built specifically to fill this gap for growth-stage SaaS companies.

Rather than forcing you to manually track dozens of competitors across hundreds of sources, Lensmor acts as an autonomous intelligence agent—continuously monitoring your competitive landscape and delivering strategic insights that actually move the needle.

Key Features:

- AI-Powered Monitoring: Automatically tracks competitors across product launches, pricing, positioning, hiring, and more.

- Strategic Synthesis: Transforms raw competitor data into actionable strategic recommendations.

- Built for SaaS: Understands SaaS business models, metrics, and competitive dynamics natively.

- Growth-Stage Pricing: Enterprise-grade intelligence without enterprise pricing or complexity.

Best For: SaaS founders and product leaders who need competitive intelligence to inform strategy but don't have the budget or bandwidth for traditional CI platforms.

Notable Strengths: Purpose-built for the unique needs of growth SaaS. While other tools try to serve every industry, Lensmor focuses exclusively on helping SaaS companies win their competitive battles. For more context on competitive strategy frameworks, see The SaaS OODA Loop: 4-Step Intelligence Framework.

6. Cognism

Primary Use Case: Global Sales Intelligence with compliance focus.

If you're building an international SaaS business, Cognism is ZoomInfo's strongest alternative—particularly in Europe where GDPR compliance is non-negotiable. Their manually verified mobile data delivers higher connect rates than competitors.

Key Features:

- Diamond Data®: Manually verified mobile numbers for key decision-makers.

- Global Compliance: Built-in GDPR, CCPA, and Do-Not-Call list compliance.

- Intent Data: Partnership with Bombora for buying signals.

Best For: International SaaS companies, particularly those with strong European presence or strict compliance requirements.

Notable Strengths: Data quality and legal safety. Cognism lets you scale international sales without compliance risk.

7. Valona Intelligence

Primary Use Case: Strategic Competitive Analysis and market monitoring.

Formerly M-Brain, Valona serves as a centralized intelligence hub for strategic decision-making. It's particularly valuable for SaaS companies competing in multiple markets or against diverse competitor sets. Compare with other options in our 9 Best Competitor Intelligence Tools guide.

Key Features:

- AI Synthesis Engine: Distills vast data volumes into executive-ready insights.

- Global Coverage: Monitors 200,000+ sources in 100+ languages.

- Automated Battlecards: Generates competitive positioning materials for sales teams.

Best For: SaaS companies with complex competitive landscapes or international operations.

Notable Strengths: Multilingual intelligence. If you're competing globally, Valona ensures you don't miss critical signals in non-English markets.

8. Contify

Primary Use Case: Personalized market intelligence feeds.

Contify treats market intelligence as a curated information service—filtering out noise and delivering only what matters to your specific strategic questions. It's particularly useful for lean teams that can't afford to drown in data.

Key Features:

- Strategic Filtering: Maps incoming signals to your Key Intelligence Questions (KIQs).

- Curated Newsfeeds: Noise-free competitor and market updates.

- Branded Newsletters: Automatically distribute intelligence to stakeholders.

Best For: Strategy-focused founders who need relevant insights without information overload.

Notable Strengths: Signal-to-noise ratio. Contify learns what matters to your business and filters ruthlessly.

9. Lantern

Primary Use Case: Revenue operations and champion tracking.

One of the highest-ROI intelligence plays in B2B SaaS: tracking when your product champions move to new companies. Lantern automates this, creating a constant flow of warm expansion opportunities.

Key Features:

- Champion Tracking: Identifies when past users join new companies.

- Job Change Signals: Monitors hiring trends and org changes.

- CRM Integration: Automatically creates opportunities in Salesforce/HubSpot.

Best For: Customer Success teams and revenue operations in product-led or expansion-focused SaaS companies.

Notable Strengths: Niche focus with massive impact. This single use case can drive 15-20% of new revenue for mature SaaS companies.

10. AlphaSense

Primary Use Case: AI-powered research for strategic decision-making.

When you need deep qualitative intelligence—understanding the "why" behind market moves—AlphaSense provides access to premium research and expert insights that Google can't surface.

Key Features:

- Smart Search: NLP-powered search across millions of professional documents.

- Wall Street Research: Access to equity research from top firms.

- Sentiment Analysis: AI tools for analyzing earnings calls and transcripts.

Best For: Strategy-focused founders and teams that need deep market understanding for major decisions.

Notable Strengths: Access to premium content. AlphaSense gives growth-stage companies research capabilities previously available only to large enterprises.

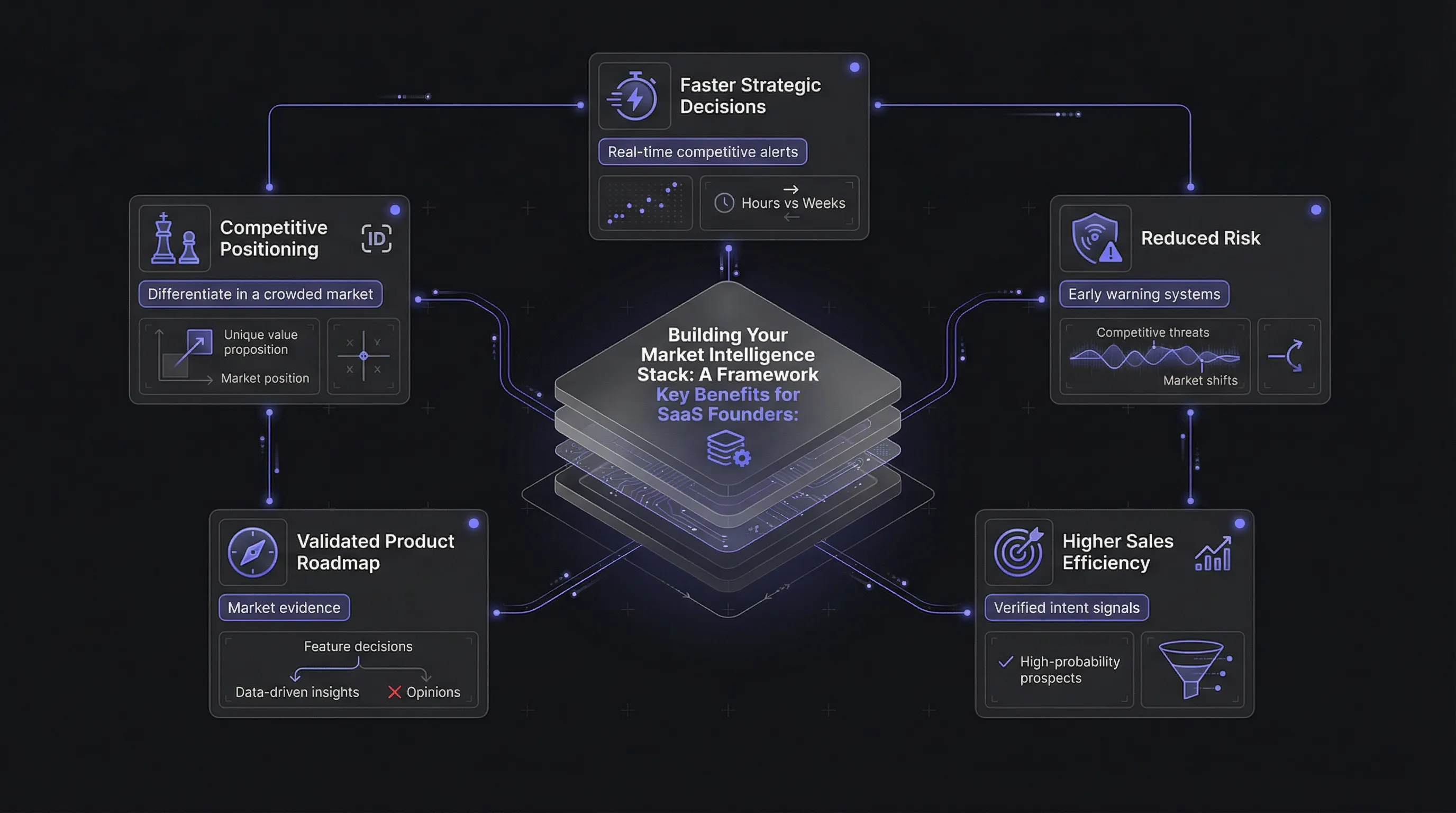

Building Your Market Intelligence Stack: A Framework

The right market intelligence stack delivers compound advantages. To see these benefits in action across different scenarios, read about 7 Real-World Competitive Intelligence Examples.

Key Benefits for SaaS Founders:

- Faster Strategic Decisions: Real-time competitive alerts let you respond to market moves within hours, not weeks.

- Reduced Risk: Early warning systems for competitive threats, market shifts, and strategic pivots.

- Higher Sales Efficiency: Focus your team on high-probability prospects with verified intent signals.

- Validated Product Roadmap: Make feature decisions based on market evidence, not opinions.

- Competitive Positioning: Understand exactly how to differentiate in a crowded market.

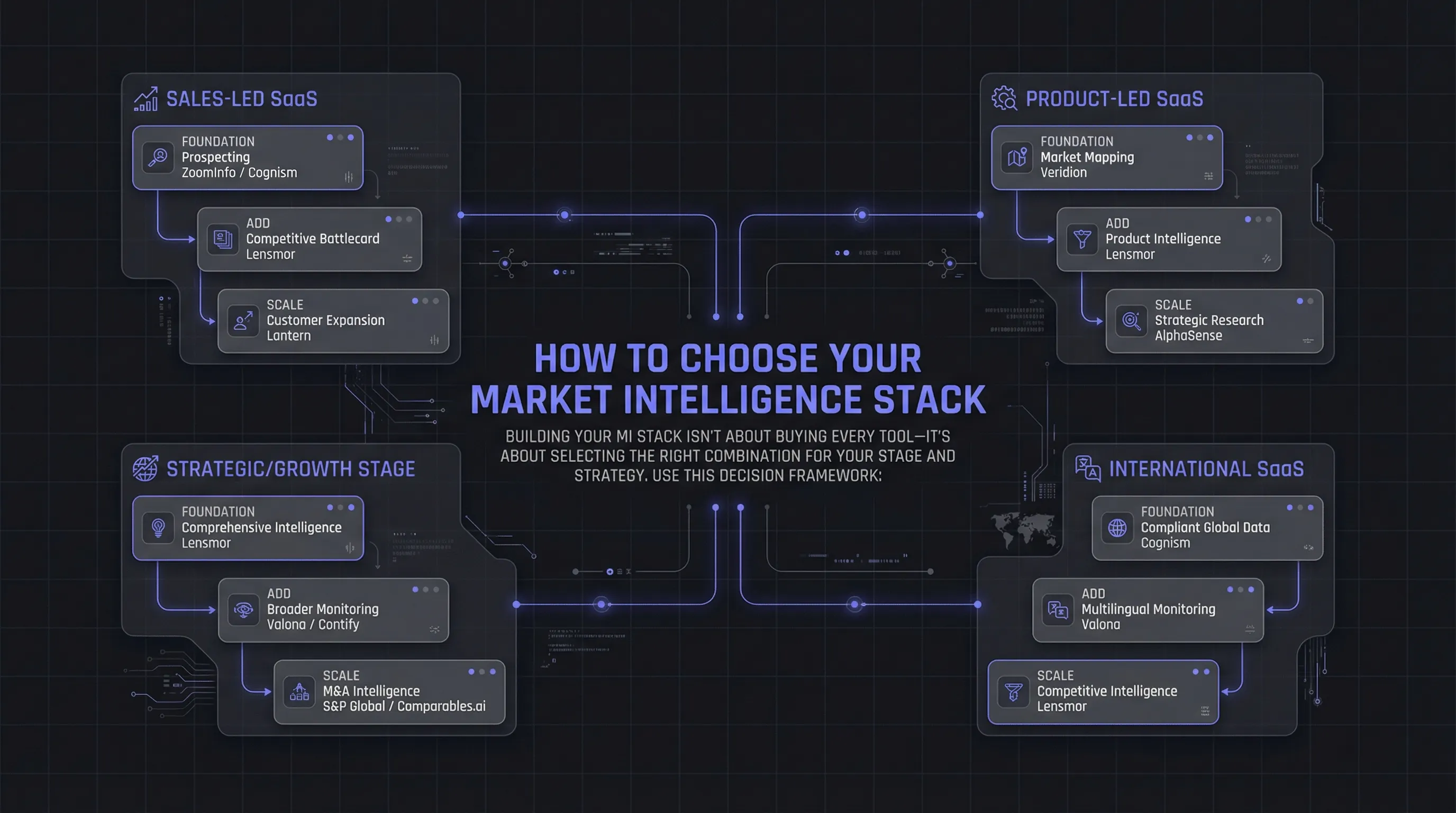

How to Choose Your Market Intelligence Stack

Building your MI stack isn't about buying every tool—it's about selecting the right combination for your stage and strategy. Use this decision framework:

For Sales-Led SaaS:

- Foundation: Start with ZoomInfo or Cognism for prospecting data.

- Add: Lensmor for competitive battlecards and positioning.

- Scale: Add Lantern for customer expansion tracking.

For Product-Led SaaS:

- Foundation: Start with Veridion for market mapping and TAM validation.

- Add: Lensmor for product competitive intelligence.

- Scale: Add AlphaSense for strategic feature research.

For Strategic/Growth Stage:

- Foundation: Start with Lensmor for comprehensive competitive intelligence.

- Add: Valona or Contify for broader market monitoring.

- Scale: Add S&P Global or Comparables.ai for M&A intelligence.

For International SaaS:

- Foundation: Start with Cognism for compliant global sales data.

- Add: Valona for multilingual market monitoring.

- Scale: Add Lensmor for competitive intelligence across markets.

Conclusion: Your Intelligence Stack is Your Competitive Advantage

As we move deeper into 2025, the gap between SaaS companies with robust market intelligence infrastructure and those flying blind continues to widen. The most successful founders treat their MI stack with the same strategic importance as their product and go-to-market stacks.

The tools in this guide represent the essential building blocks for modern SaaS competitive advantage. Start with the foundation that addresses your most critical gap—whether that's sales prospecting, competitive intelligence, or market mapping. Then layer in complementary tools as you scale.

Remember: Your competitors are already building their intelligence capabilities. The question isn't whether to invest in market intelligence—it's whether you'll do it before or after they gain an insurmountable advantage.

Frequently Asked Questions (FAQs)

Q: What's the difference between market intelligence and competitive intelligence?

A: Market intelligence covers the broader landscape—industry trends, customer behaviors, regulatory changes, and market dynamics. Competitive Intelligence (like what Lensmor provides) focuses specifically on competitor moves, positioning, and strategy. Most SaaS companies need both, but competitive intelligence typically drives more immediate action.

Q: How much should a growth-stage SaaS company budget for market intelligence tools?

A: For a typical Series A-B SaaS company, expect to allocate $30K-$60K annually across 2-3 core MI tools. Enterprise tools like S&P Global or ZoomInfo can cost $20K-$50K+ per year, while purpose-built SaaS tools like Lensmor offer enterprise capabilities at $1K-$2K annually. Start with one or two high-impact tools and expand as ROI is proven.

Q: Can these tools integrate with my existing tech stack?

A: Yes, most modern MI tools offer native integrations with standard SaaS tools. ZoomInfo, Cognism, and Lantern integrate directly with CRMs like Salesforce and HubSpot. Tools like Lensmor typically integrate with your communication stack (Slack, email) to deliver insights where your team already works. Always verify integration capabilities during evaluation.