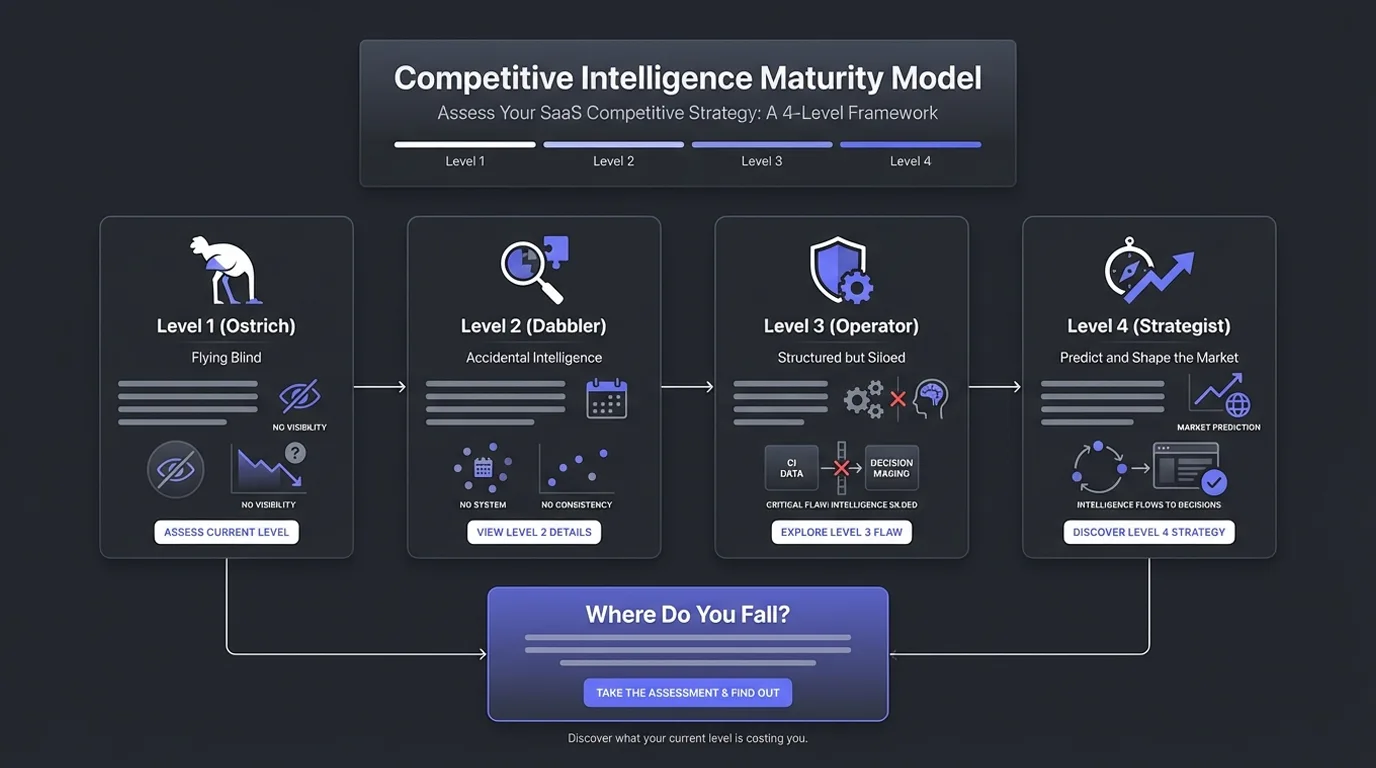

TL;DR: Most SaaS companies think they're doing competitive intelligence. They're not. This guide introduces the Competitive Intelligence Maturity Model—a 4-level framework to assess your SaaS Competitive Strategy. Level 1 (Ostrich) companies are flying blind. Level 4 (Strategist) companies predict and shape the market. Where do you fall? Read on to find out—and discover what your current level is costing you.

Be honest. When was the last time a competitor's move blindsided you? A feature launch you didn't see coming. A pricing change that undercut your biggest deal. A startup you'd never heard of suddenly winning your target accounts. If you felt that sting, you're not alone—but you might be more vulnerable than you think.

Here's the uncomfortable truth: 73% of SaaS companies have no formal competitive intelligence process. They have a Slack channel where links go to die. They have "battlecards" last updated in 2022. They have founders who say "we don't have competitors" while losing deals to companies they've never analyzed.

The companies that dominate their markets don't just monitor competition—they've built organizational muscle for intelligence. They've climbed the Competitive Intelligence Maturity Model.

This framework will help you diagnose exactly where your organization stands—and what it's costing you to stay there.

The 4-Level Competitive Intelligence Maturity Model

Let's break down each level. As you read, ask yourself: Which description makes you wince with recognition?

Level 1: The Ostrich 🙈

Motto: "We're so differentiated we don't really have competitors."

The Ostrich has their head buried deep in the sand. They genuinely believe their product is so unique that competitive intelligence is unnecessary. Spoiler: it's not.

Characteristics

- No dedicated CI process, tools, or owner

- Competitive discussions happen only when a deal is lost

- Founders dismiss competitors as "not really in our space"

- Sales reps Google competitors during discovery calls

- Product roadmap is entirely internally driven

Warning Signs You're an Ostrich

- You learn about competitor moves from your customers

- Your sales team says "I don't know" when prospects mention alternatives

- You've never interviewed a lost prospect

- The phrase "competitive landscape" isn't in your vocabulary

- You're genuinely surprised when you read this list

What It's Costing You

Lost deals you never understood: Without Win/Loss Analysis, you have no idea why you're losing. You blame price when it's positioning. You blame features when it's trust.

Strategic blindspots: A competitor just raised $50M to attack your market segment. You'll find out when they steal your customers.

The math: If you lose 10 deals/quarter to competitors you don't understand, at $30K ACV, that's $1.2M/year in preventable losses.

The Ostrich's Wake-Up Call

"We lost three enterprise deals in a row to a competitor I'd never heard of. When I finally looked them up, they'd been in market for 18 months and had 47 case studies in our target vertical. We looked like fools."

— VP Sales, Series B SaaS (anonymous)

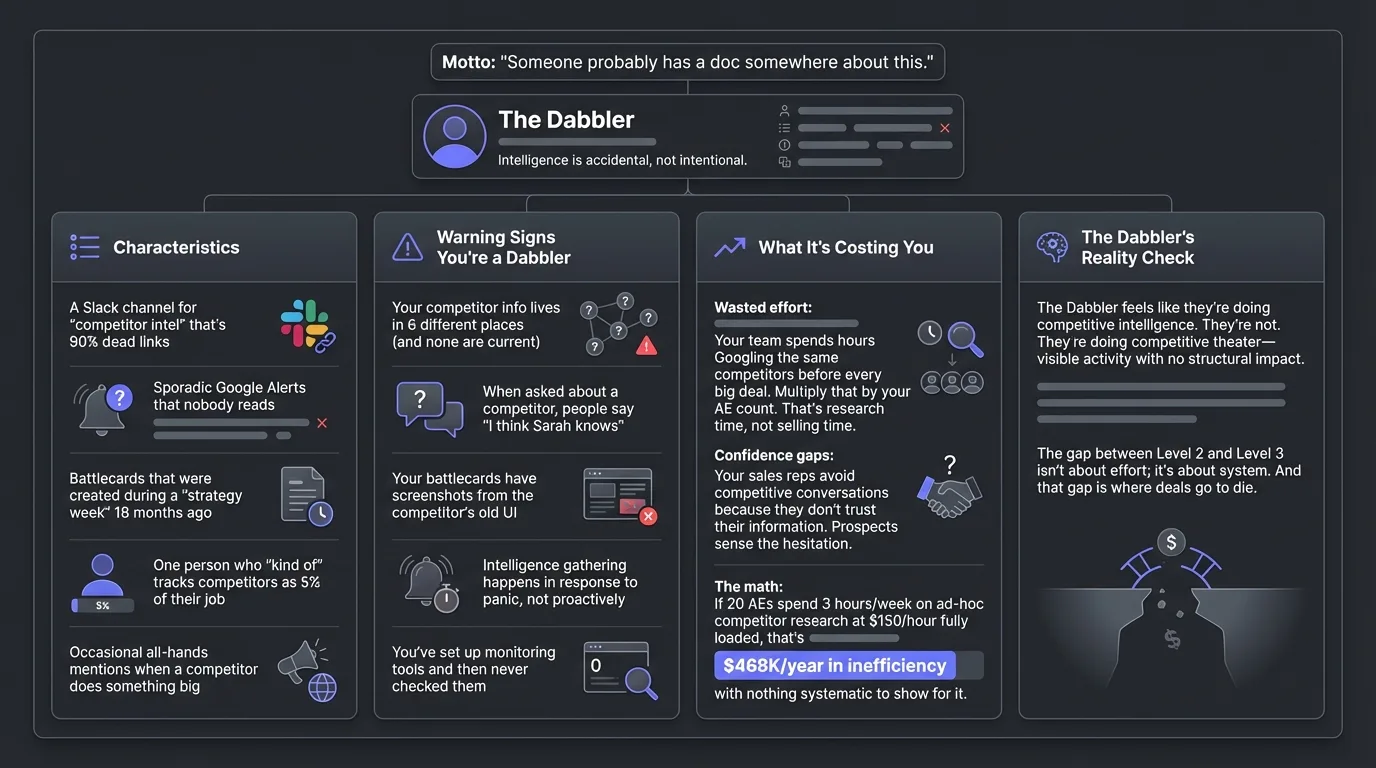

Level 2: The Dabbler 📎

Motto: "Someone probably has a doc somewhere about this."

The Dabbler knows competitors exist and occasionally pays attention—but there's no system, no consistency, and no follow-through. Intelligence is accidental, not intentional.

Characteristics

- A Slack channel for "competitor intel" that's 90% dead links

- Sporadic Google Alerts that nobody reads

- Battlecards that were created during a "strategy week" 18 months ago

- One person who "kind of" tracks competitors as 5% of their job

- Occasional all-hands mentions when a competitor does something big

Warning Signs You're a Dabbler

- Your competitor info lives in 6 different places (and none are current)

- When asked about a competitor, people say "I think Sarah knows"

- Your battlecards have screenshots from the competitor's old UI

- Intelligence gathering happens in response to panic, not proactively

- You've set up monitoring tools and then never checked them

What It's Costing You

Wasted effort: Your team spends hours Googling the same competitors before every big deal. Multiply that by your AE count. That's research time, not selling time.

Confidence gaps: Your sales reps avoid competitive conversations because they don't trust their information. Prospects sense the hesitation.

The math: If 20 AEs spend 3 hours/week on ad-hoc competitor research at $150/hour fully loaded, that's $468K/year in inefficiency—with nothing systematic to show for it.

The Dabbler's Reality Check

The Dabbler feels like they're doing competitive intelligence. They're not. They're doing competitive theater—visible activity with no structural impact.

The gap between Level 2 and Level 3 isn't about effort; it's about system. And that gap is where deals go to die.

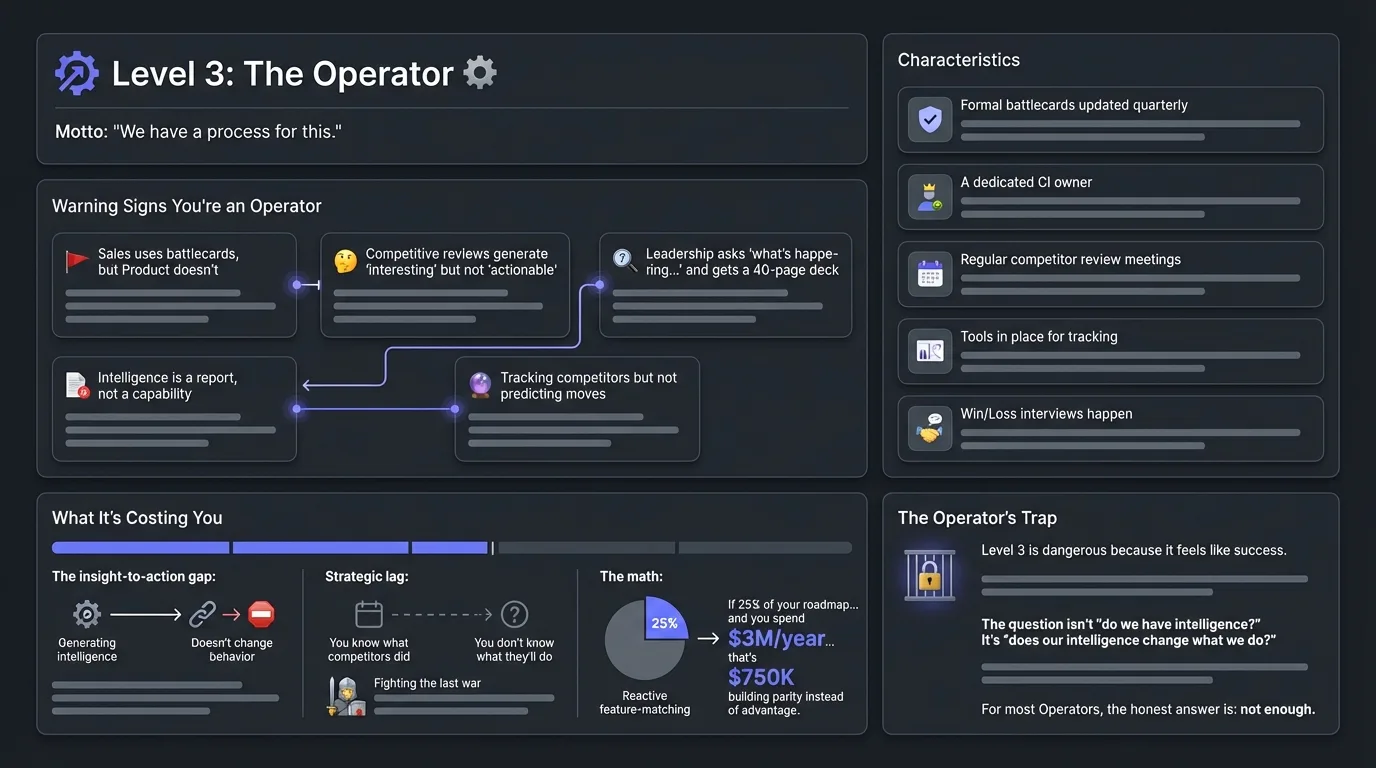

Level 3: The Operator ⚙️

Motto: "We have a process for this."

The Operator has done the work. They have dedicated battlecards, regular competitor reviews, and someone who actually owns CI. But there's a critical flaw: intelligence stays siloed. It doesn't flow to decisions.

Characteristics

- Formal battlecards updated quarterly (or when someone complains)

- A dedicated CI owner (often in Product Marketing)

- Regular competitor review meetings (that Product sometimes skips)

- Tools in place for tracking (but insights don't reach executives)

- Win/Loss interviews happen (but findings don't change the roadmap)

Warning Signs You're an Operator

- Sales uses battlecards, but Product doesn't read the win/loss reports

- Your competitive reviews generate "interesting" but not "actionable"

- Leadership asks "what's happening with competitors?" and gets a 40-page deck

- Intelligence is a report people receive, not a capability people have

- You're tracking competitors but not actually predicting their moves

What It's Costing You

The insight-to-action gap: You're generating intelligence, but it doesn't change behavior. Sales might have better battlecards, but Product is still building features your market doesn't need.

Strategic lag: You know what competitors did. You don't know what they'll do. You're fighting the last war.

The math: If 25% of your roadmap is reactive feature-matching instead of differentiated innovation, and you spend $3M/year on engineering, that's $750K building parity instead of advantage.

The Operator's Trap

Level 3 is dangerous because it feels like success. You have the artifacts of good CI—the battlecards, the tracking, the meetings. But artifacts aren't outcomes.

The question isn't "do we have intelligence?" It's "does our intelligence change what we do?"

For most Operators, the honest answer is: not enough.

Level 4: The Strategist 🎯

Motto: "We saw this coming six months ago."

The Strategist doesn't just track competitors—they anticipate them. Intelligence isn't a function; it's a capability woven into every major decision. They shape the market because they understand it better than anyone.

Characteristics

- CI insights directly influence roadmap prioritization and pricing decisions

- Cross-functional intelligence loops: Sales feeds Product feeds Marketing feeds Sales

- Predictive competitive analysis: "Based on their hiring and funding, they'll move into X"

- Executives ask "what does the competitive context say?" before major decisions

- Win/loss insights close the loop: Lost deal patterns change the product

What Strategists Do Differently

They predict, not just track. When a competitor posts 5 AI engineering roles, they don't just note it—they model what product that signals and prepare their response.

They distribute, not just document. Insights reach the right person in the right format: Battlecards for sales, deep dives for product, dashboards for executives.

They operationalize, not just analyze. Every insight has an owner and an action. "Interesting" is not a valid outcome.

The Strategist's Advantage

Market anticipation: They know where competitors are going before the press release drops.

Confident sales: Reps walk into every competitive deal knowing they can win—and how.

Strategic differentiation: Instead of copying competitors, they find the whitespace others miss.

The math: A 15% improvement in competitive win rate at $50K ACV across 200 competitive deals = $1.5M in incremental revenue.

Self-Assessment: Which Level Are You?

Be honest. For each question, note which level's answer sounds most like your company.

Question 1: When a competitor launches a major feature, how do you find out?

- Ostrich: A customer mentions it, or we see it on LinkedIn

- Dabbler: Someone posts it in Slack, maybe

- Operator: Our CI owner sends an alert within 48 hours

- Strategist: We knew it was coming and had our response ready

Question 2: Where do your battlecards live?

- Ostrich: What battlecards?

- Dabbler: Google Drive somewhere... let me search

- Operator: Our enablement platform, updated quarterly

- Strategist: Embedded in our CRM, updated monthly with win/loss data

Question 3: How does competitive intelligence influence your product roadmap?

- Ostrich: It doesn't

- Dabbler: Sometimes Product asks about competitors

- Operator: We have quarterly competitive reviews that Product attends

- Strategist: Win/loss patterns directly inform prioritization

Question 4: What happens after a lost deal?

- Ostrich: We move on to the next deal

- Dabbler: Sometimes we ask the prospect why, informally

- Operator: We do structured win/loss interviews and document findings

- Strategist: Patterns from lost deals trigger product changes within 60 days

Question 5: How would you describe your competitive intelligence "culture"?

- Ostrich: We're focused on building, not watching competitors

- Dabbler: A few people care; most don't think about it

- Operator: Product Marketing owns it; others contribute when asked

- Strategist: Everyone feeds the system; intelligence is a shared capability

Score Yourself

- Mostly Ostrich: You're in danger.

- Mostly Dabbler: You're aware but ineffective. You need structure, not more Slack messages.

- Mostly Operator: You're capable but siloed. Focus on distribution and decision integration.

- Mostly Strategist: You're ahead—keep evolving. The market never stops moving.

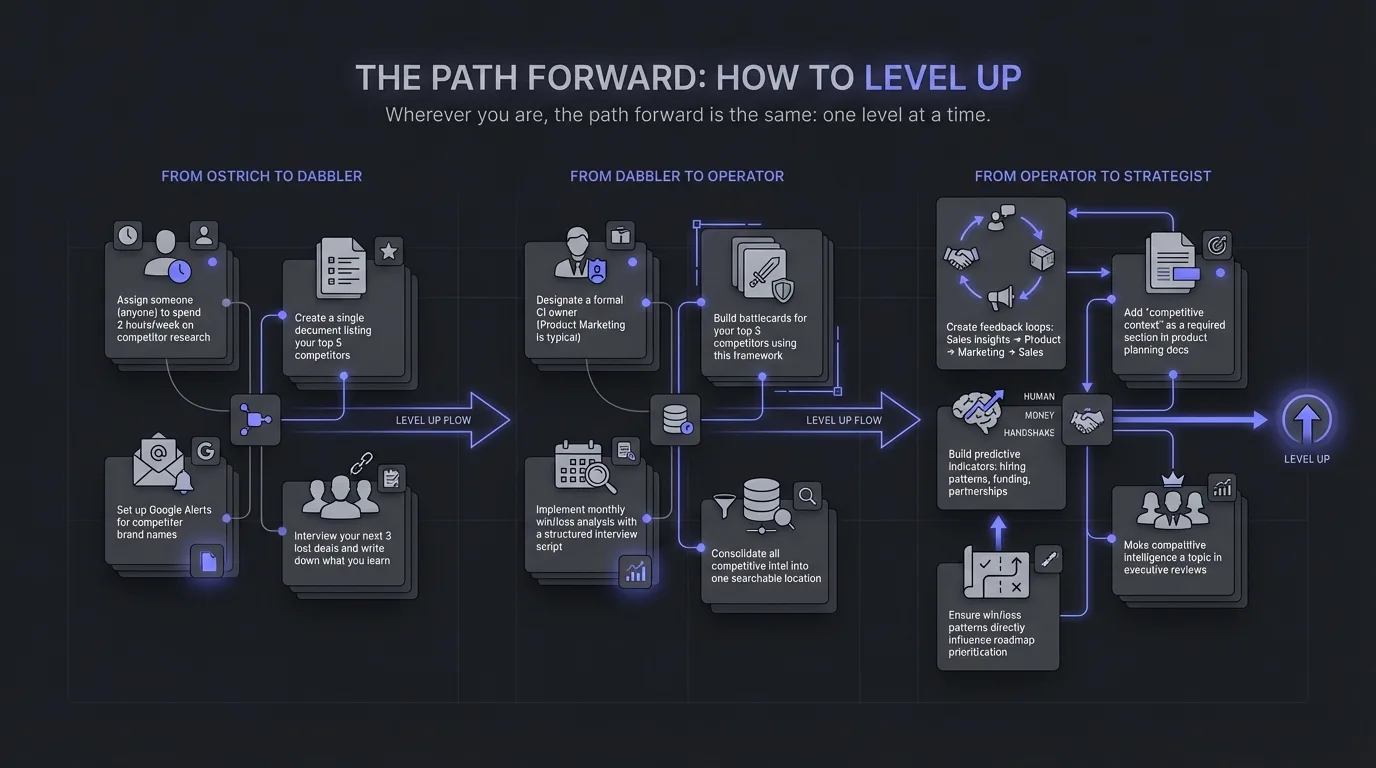

The Path Forward: How to Level Up

Wherever you are, the path forward is the same: one level at a time.

From Ostrich to Dabbler

- Assign someone (anyone) to spend 2 hours/week on competitor research

- Create a single document listing your top 5 competitors

- Set up Google Alerts for competitor brand names

- Interview your next 3 lost deals and write down what you learn

From Dabbler to Operator

- Designate a formal CI owner (Product Marketing is typical)

- Build battlecards for your top 3 competitors using this framework

- Implement monthly win/loss analysis with a structured interview script

- Consolidate all competitive intel into one searchable location

- Use competitor intelligence tools to automate tracking

From Operator to Strategist

- Create feedback loops: Sales insights → Product → Marketing → Sales

- Add "competitive context" as a required section in product planning docs

- Build predictive indicators: hiring patterns, funding, partnerships

- Ensure win/loss patterns directly influence roadmap prioritization

- Make competitive intelligence a topic in executive reviews

🚀 Accelerate Your CI Maturity with Lensmor

Climbing the Competitive Intelligence Maturity Model takes time—unless you have the right tools.

We're building Lensmor, the intelligent CI Agent designed to accelerate your journey from Dabbler to Strategist. Lensmor automates competitor tracking, surfaces predictive signals, and delivers insights in formats your teams will actually use.

Stop being an Ostrich. Stop the random acts of intelligence.

🔥 Limited Time Pre-Launch Offer:Join our Waitlist now to secure 50% OFF your subscription and get a Free Backlink when we go live.

Frequently Asked Questions (FAQs)

Q: How long does it take to move up one level in the Maturity Model?

A: Most companies can move from Ostrich to Dabbler in 30 days. Dabbler to Operator takes 3-6 months of consistent effort. Operator to Strategist requires 6-12 months of cultural change and process integration.

Q: We're a small startup. Is competitive intelligence worth the investment?

A: Absolutely. Early-stage companies have the most to lose from blindspots. You don't need expensive tools—you need a habit. Start with win/loss interviews and a simple competitor tracking doc.

Q: Who should own competitive intelligence?

A: At most SaaS companies, Product Marketing owns the framework and distribution. But CI is a team sport: Sales provides frontline intel, Product acts on insights, and Executives set the strategic direction.

Q: What's the biggest mistake companies make when building CI capabilities?

A: Creating artifacts without action. Battlecards nobody reads, reports nobody changes behavior from, meetings that generate "interesting" but not "actionable." The goal isn't documents—it's decisions.

Q: Can we skip levels in the Maturity Model?

A: Not really. Each level builds capabilities the next level requires. You can accelerate progression with the right tools and focus, but you can't skip the foundational work.