In the white-hot global AI competition, finding your market fit is no longer just about product innovation—it’s about precision navigation. How do you find your "North Star" amidst the noise?

TL;DR: Short on time? Here's the gist: Learning how to do competitive analysis is critical for AI SaaS survival. You must dissect your rival's launch timing, Ad Spend Analysis, and User Feedback Mining. This guide uses the real-world case of Lovart to show you how to turn Market Intelligence into a growth engine.

In the fast-paced world of AI, knowing how to do competitive analysis is no longer just about product innovation—it's about precision navigation. The answer lies in deep, tactical competitive analysis.

This guide moves beyond theory. We break down a real-world battle strategy using Lovart (a vertical AI design agent) to show you exactly how to deconstruct a competitor’s positioning, ad spend, and user feedback to find your own path to growth.

Step 1: Deconstruct the "First Mover" Strategy

When analyzing a competitor like Lovart, which successfully claimed the user mindshare as the "World's First AI Design Agent," you need to look at when and how they launched. For a broader methodology, see our guide on How to Gather Competitive Intelligence.

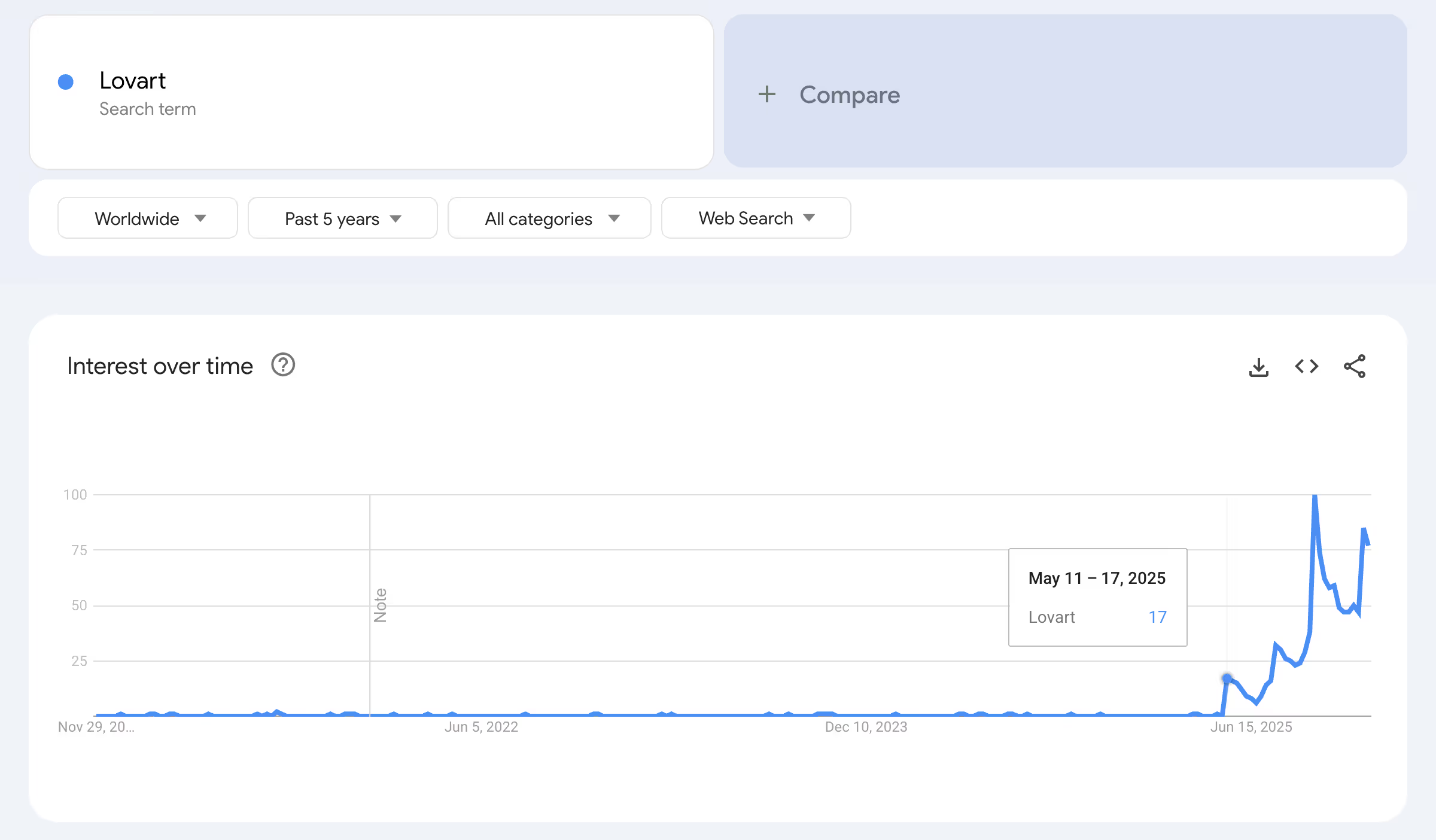

1. Analyze Search Interest & Timing

Use Google Trends to identify the brand's inception point.

- The Lovart Case: Data shows a spike in May. Why? They capitalized on the "Agent" concept popularized by Manus in March. While the market was educated on what an "Agent" was, Lovart swooped in to claim the vertical niche of "Design Agent."

- Takeaway: Timing is everything. Launching a "Vertical Agent" immediately after a "General Agent" educates the market reduces your education costs.

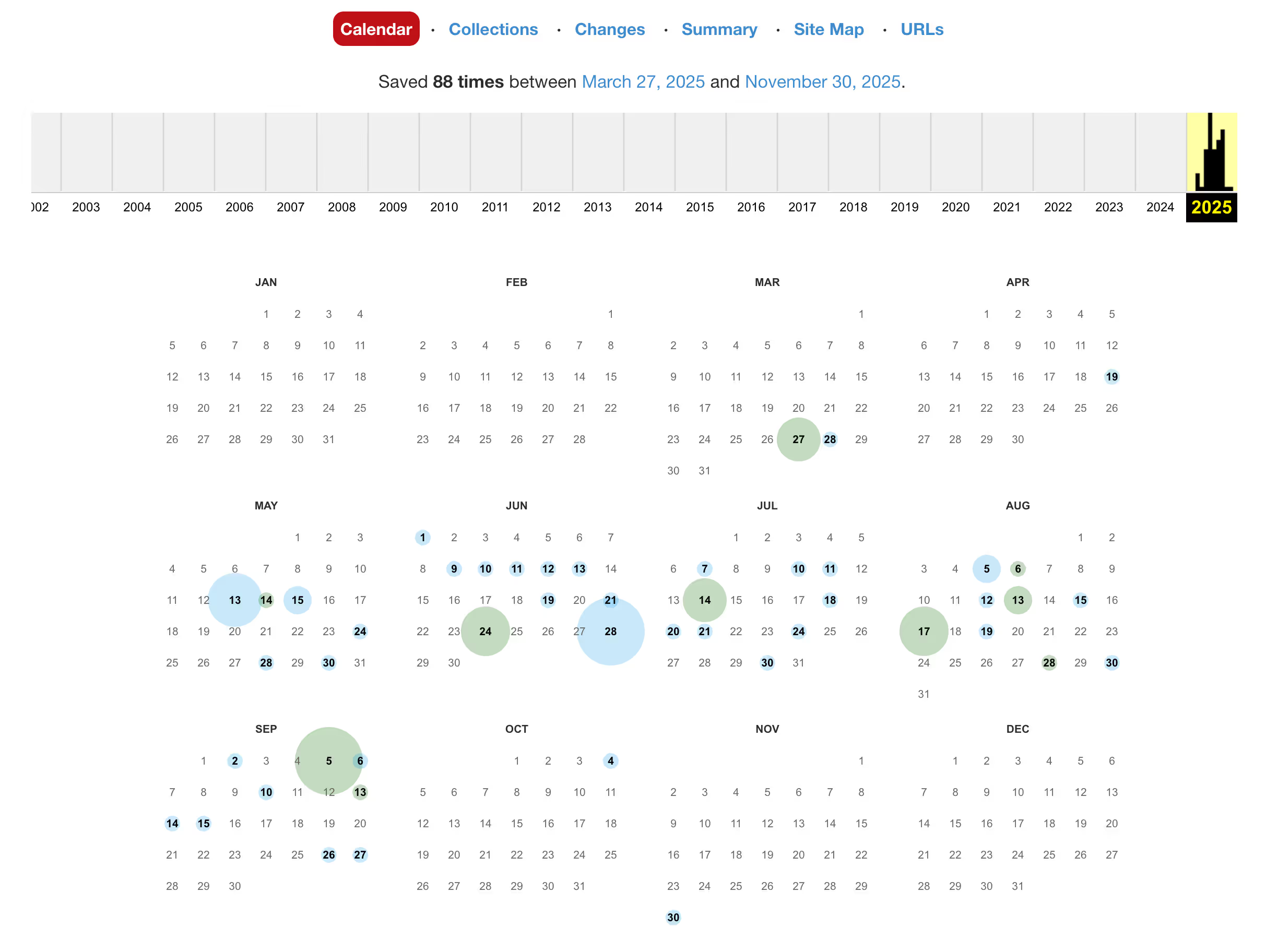

2. Trace Historical Positioning

Use the Wayback Machine to view the competitor's website during their launch month.

- The Lovart Case: In May/June, their homepage explicitly featured the tagline "The First AI Agent." They didn't waver.

- Takeaway: Consistency in value proposition during the launch phase is critical for occupying user mindshare.

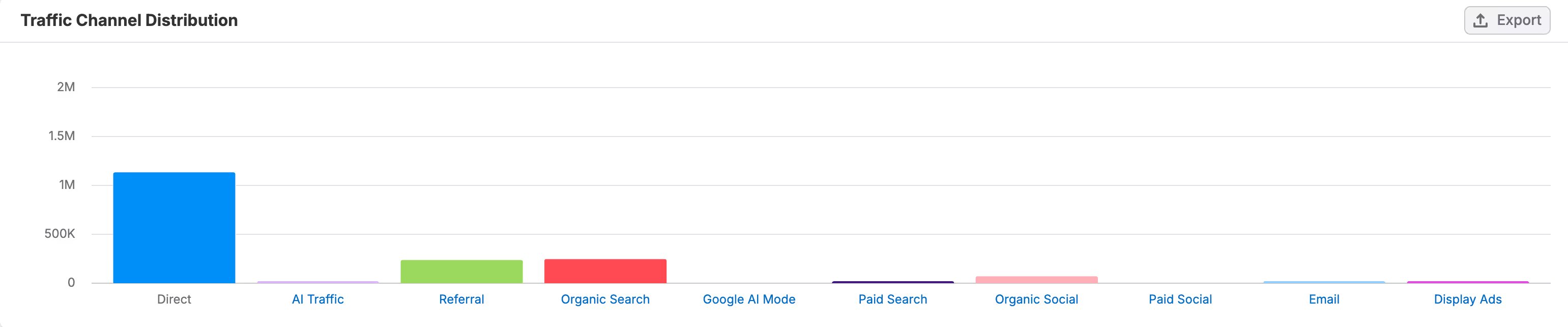

3. Traffic Source Analysis

Use tools like Semrush to analyze traffic composition during the launch peak.

- Direct Traffic: Often high for new brands, but usually masks dark social or untracked campaigns.

- Referral & Social: Look closely here. Lovart drove massive traffic via Twitter (X), YouTube, and Facebook.

- Deep Dive: Don't just look at the platform; look at the voices. Lovart utilized top-tier influencers who uniformly stuck to the script: "The All-in-One AI Design Agent."

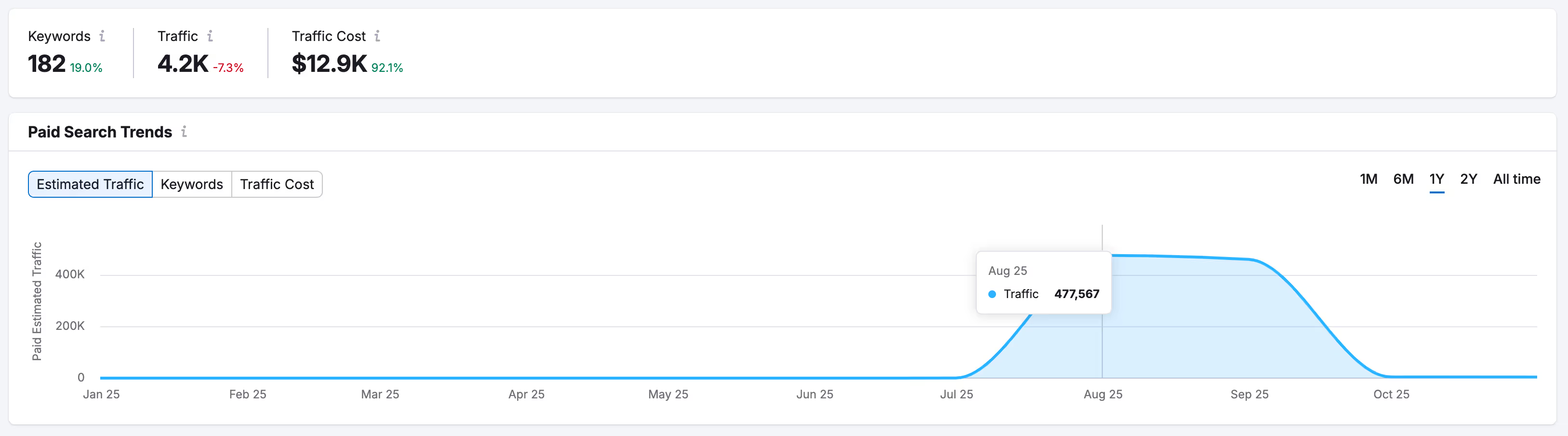

Step 2: Audit the "Burn Rate" (Ad Spend Analysis)

A competitor's spending habits reveal their growth stage and strategy. Tools listed in our 9 Best Competitor Intelligence Tools review can help you track this data.

1. Follow the Money

Lovart’s data reveals a massive spike in paid traffic in August/September, estimated at $400k/month.

- The Strategy: This aggressive "Blitzscaling" occurred right after their product launch (and likely after a fundraising round, such as their reported $130M financing).

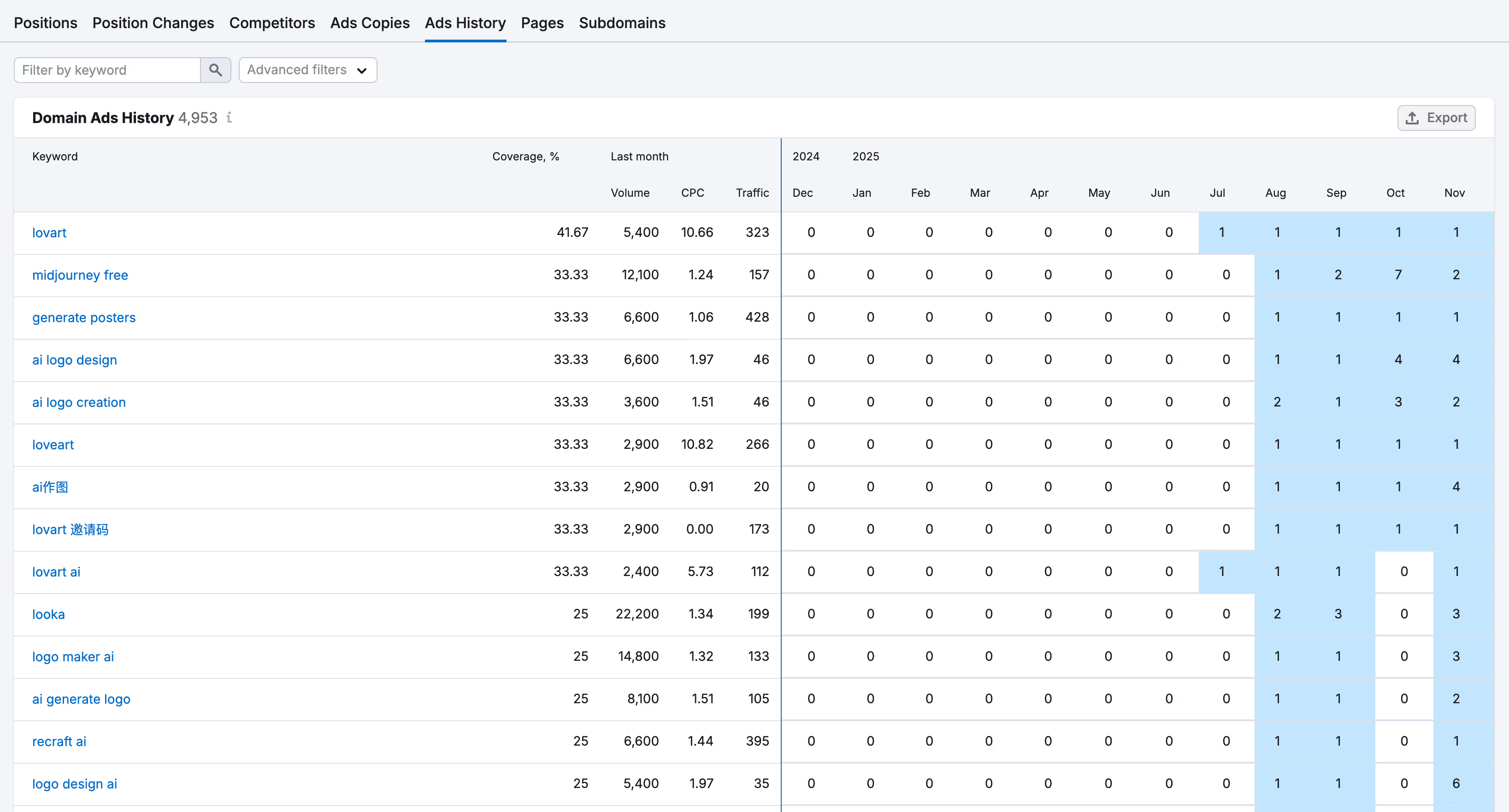

2. Analyze Keyword Coverage

Download their paid keyword list.

- The Lovart Case: They bid on over 3,000 keywords, ranging from broad terms ("Image," "Video," "3D") to competitor brand names.

- The Anomaly: They directed almost all traffic to their Homepage, rather than specific Landing Pages (LPs).

- Takeaway: This suggests a strategy focused on Volume over Efficiency. They wanted user acquisition and brand awareness at any cost, rather than optimizing for specific conversion funnels (e.g., a specific LP for "AI Logo Maker"). Note: For bootstrapped startups, avoid this; use targeted LPs.

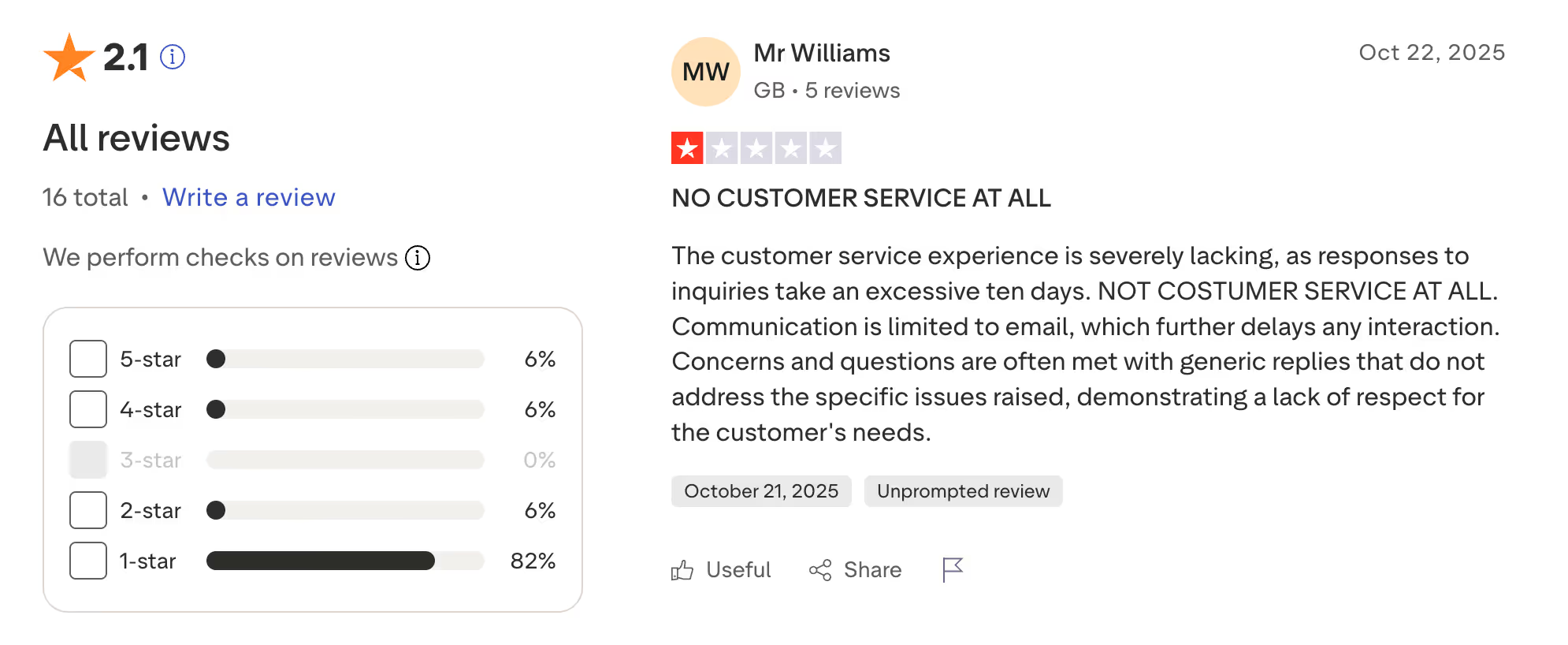

Step 3: Mine User Feedback for "Golden Gaps"

Your competitor's weakness is your opportunity. Don't rely on AI summaries alone; read the raw data to understand the emotion behind the complaints. Learn more about this technique in 7 Real-World Competitive Intelligence Examples.

1. Where to Find Truth

- Trustpilot/G2: Good for volume, but filter for 3-star reviews or lower to filter out paid/bot positive reviews.

- Reddit: Authentic, unfiltered discussions, though harder to search.

- App Stores: If they have a mobile app, this is a goldmine for UX feedback.

2. The AI SaaS Pain Points

Unlike traditional SaaS (where complaints focus on bugs or pricing), AI SaaS users have unique frustrations. In the case of Lovart and similar tools (like Higgsfield), common complaints include:

- The "Credit" Trap: Users hate "Unlimited" plans that actually have hidden caps or credit limits.

- Consistency: "The video looked good in the demo, but my generation looks terrible."

- Pricing Transparency: Hidden auto-renewals or unclear credit consumption rates.

3. The Opportunity

If you see users complaining that Lovart is "too expensive for inconsistent results" or "customer support is slow," you can position your product as the "Transparent, High-Consistency Alternative."

Step 4: Determine the Market Ceiling

Before you attack a market, you need to know how big the pie is. Use 10 Best Market Intelligence Software to get accurate traffic data.

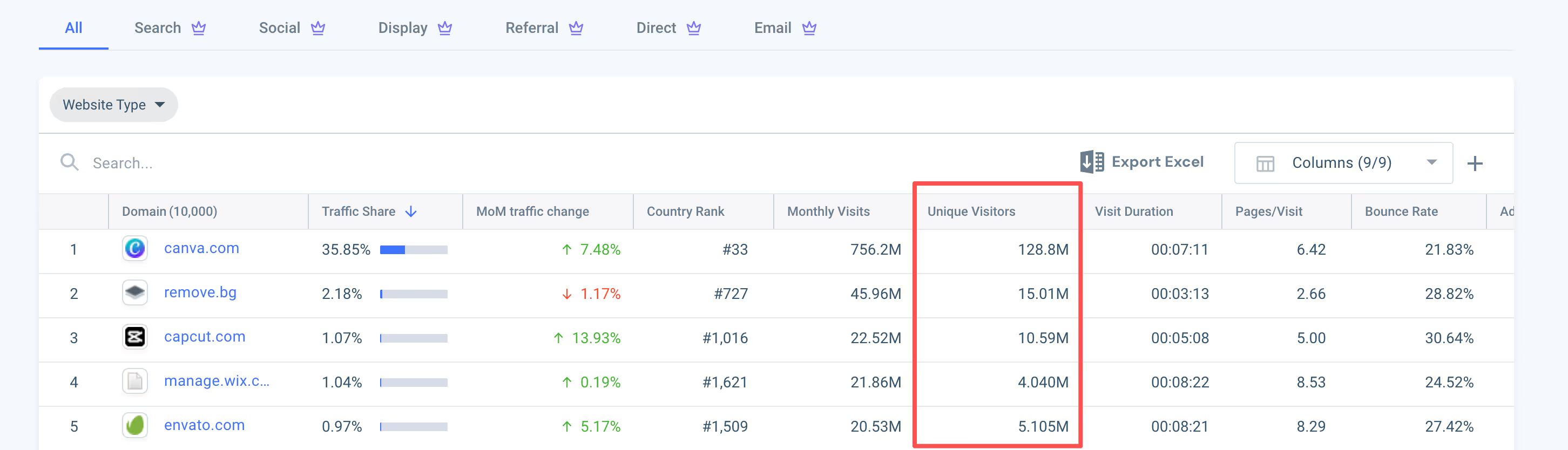

1. Identify the "Goliath"

Who is the absolute leader in your space?

- Design Sector: Canva or Adobe.

- Data: Canva pulls in roughly 700M - 900M monthly visits.

2. Calculate Your Potential

If the market leader has 900M visits, and a strong vertical AI competitor (like Lovart) is getting X million, you can estimate your potential revenue.

- Calculation: Traffic × Conversion Rate × ARPU (Average Revenue Per User) = Potential Revenue.

- Insight: The AI boom has expanded the Total Addressable Market (TAM). Tools are now doing things (like instant video generation) that traditional tools couldn't, meaning the ceiling is higher than it was 5 years ago.

Summary: How to Do Competitive Analysis (Checklist)

🚀 Coming Soon: The CI Agent for Growth SaaS

Stop settling for tools that are too simple or too expensive. We're building Lensmor, the intelligent CI Agent designed to bridge the gap for Growth SaaS companies.

Lensmor automates the heavy lifting of competitive tracking, delivering strategic insights that actually move the needle—without the enterprise price tag.

🔥 Limited Time Pre-Launch Offer:

Don't miss out! Join our Waitlist now to secure 50% OFF your subscription and get a Free Backlink when we go live.

Conclusion

By systematically dismantling your competitors' strategies—from their launch timing to their ad spend—you stop guessing and start executing based on proven market data. Whether you are building the next vertical AI agent or a horizontal platform, the blueprint is already out there; you just need to read it.

Start your analysis today. Pick one competitor, run them through this checklist, and find your wedge in the market.

Frequently Asked Questions (FAQs)

Q: How much ad spend is normal for an AI SaaS launch?

A: It varies wildly. Venture-backed startups like Lovart may burn $400k/month to capture market share, while bootstrapped tools should focus on organic SEO and targeted long-tail keywords.

Q: What is the best free tool for competitive analysis?

A: Google Trends is excellent for gauging brand interest over time. For traffic estimates, the free version of SimilarWeb provides a decent high-level overview.

Q: How do I track competitor pricing changes?

A: Use automated monitoring tools like Visualping or check out our Ultimate Competitor Intelligence Framework Guide for manual tracking templates.