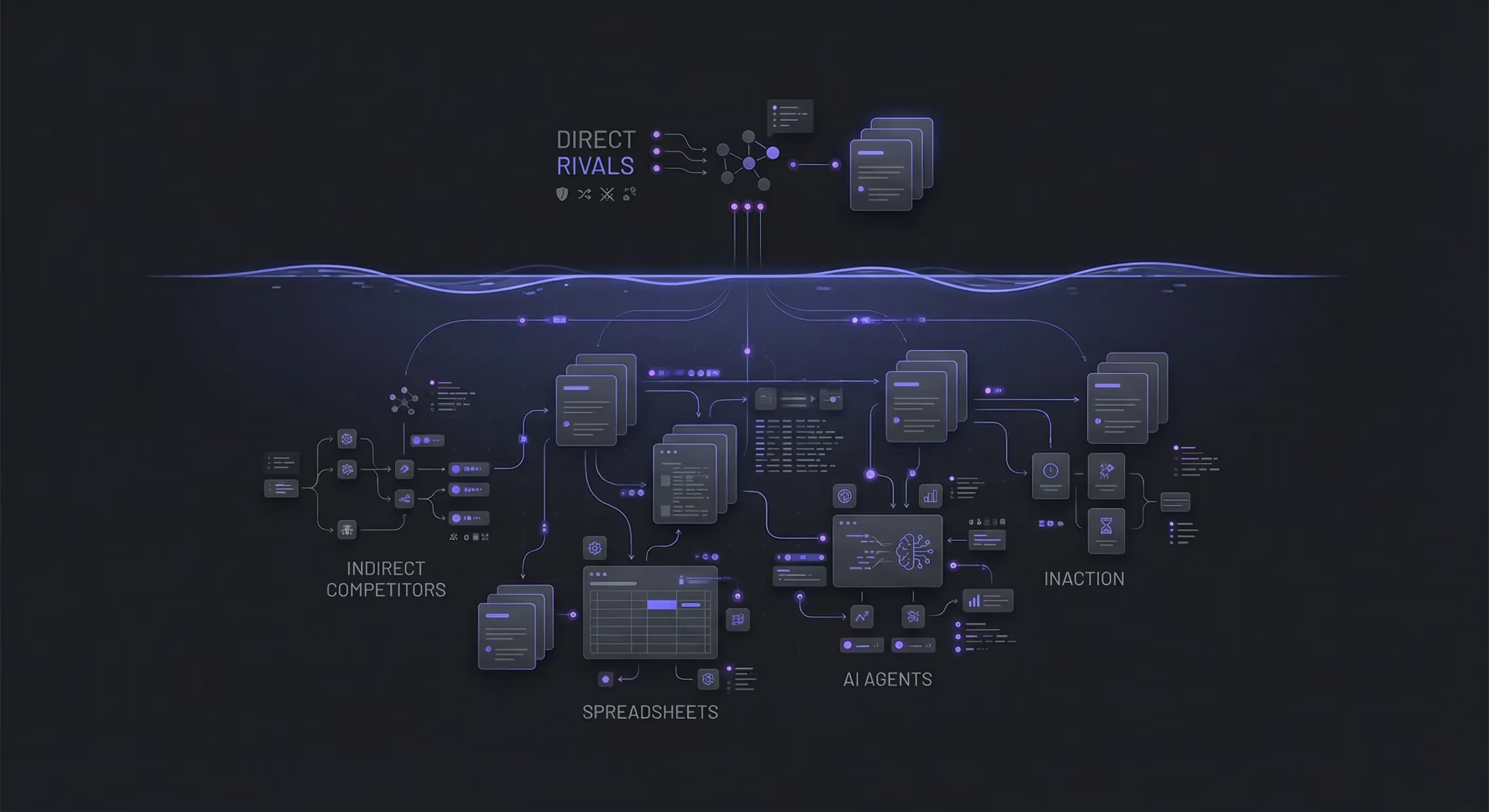

TL;DR:Most founders are obsessed with the wrong enemies. While you’re busy feature-matching your direct rivals on G2, indirect competitors—tools that solve the same problem differently—are quietly siphoning off your best leads. Lensmor found that in 2025, 60% of lost deals aren’t going to a direct rival, but to "good enough" workarounds like AI agents, spreadsheets, or even doing nothing. This post dissects why static competitive maps are dead and introduces the Agile CI framework: a method to track intent rather than just features, ensuring you never get blindsided again.

The Silent Killer: Why Your "Direct" Rivals Are the Least of Your Worries

Here is a scenario that should keep you awake at night: You just shipped a massive feature update. You achieved parity with your top competitor. You lowered your prices by 10%. On paper, you should be winning.

But your churn rate is climbing. Your demo requests are flatlining.

Why? Because your customers aren't switching to the competitor you’re watching. They’re switching to a tool you didn't even think was in your category. They aren't buying your "better project management software"; they are hiring an AI agent to do the project management for them.

In 2026, the battleground has shifted. The data is clear: indirect competitors are the primary cause of unexplained revenue bleed.

The Old Way: The "Feature Parity" Trap

For the last decade, competitive intelligence (CI) has been lazy. It typically looks like this:

- The G2 Grid Obsession: You scrape G2 or Capterra, list the top 5 companies in your category, and obsess over their feature lists.

- The Static Venn Diagram: You create a pretty slide for your investors showing how you sit in the "Goldilocks zone" of Price vs. Performance.

- Pixel Peeping: You use tools like Visualping to monitor when a competitor changes a button color or updates a headline.

This is wrong.

Lensmor found that 99% of these alerts are noise. Knowing your competitor changed their H1 tag doesn't help you make a strategic decision. Worse, this approach locks you into the Feature Parity Trap—building features just because they have them, rather than because your customers need them. You become a faster horse in a world inventing cars.

As we discussed in The Age of Agile Intelligence: Why Static Competitive Strategy is Dead in 2026, static maps fail because they assume the market is frozen. They ignore the fluid nature of customer intent.

Insider Note: If you are only watching companies that look like you, you are already losing. Netflix didn't kill Blockbuster just by being a better video store; they killed it by being a better way to spend an evening.

The New Way: Agile CI and Intent Recognition

The solution is not to monitor more competitors; it’s to monitor intent. This is the core of the Lensmor Methodology: Agile Competitive Intelligence (Agile CI).

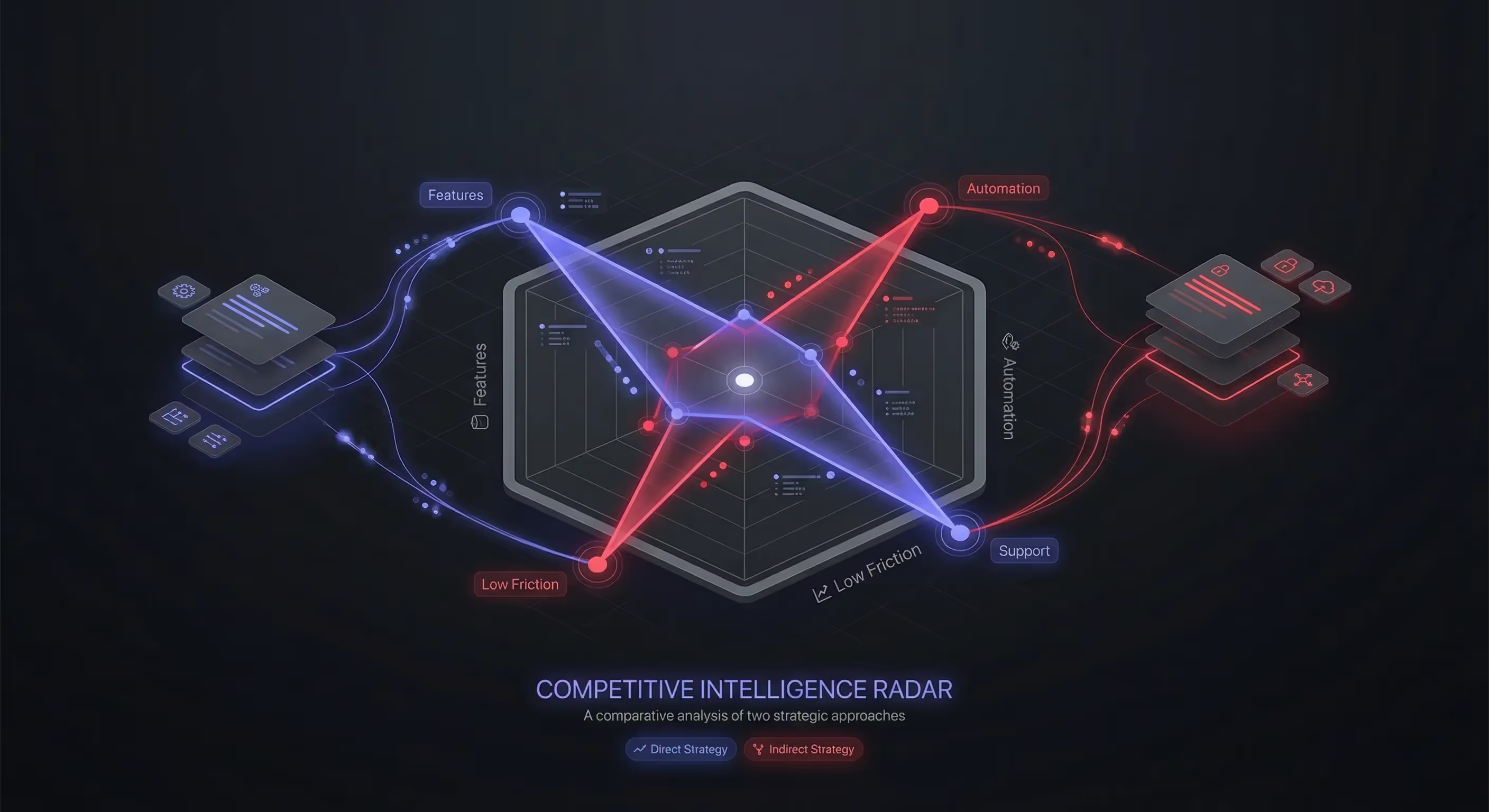

Agile CI doesn't ask, "What features does Competitor X have?"It asks, "What Job to be Done (JTBD) is the customer trying to achieve, and who else is helping them do it?"

The Lensmor Difference: Intent Recognition

Instead of static keywords, we use intent recognition. We analyze the problems your audience is searching for and identifying the solutions they are finding—regardless of category.

For example, if you sell "SEO Software," your Old Way CI tracks Ahrefs and SEMrush.Lensmor’s Agile CI tracks the intent "how to rank higher." It instantly flags that users are now using "Perplexity AI" or "ChatGPT Custom GPTs" to solve this problem. Suddenly, an AI chat bot is your biggest indirect competitor.

We break this down into specific Action Plans:

- Signal Detection: Identify the intent shift (e.g., users searching for "automated writing" instead of "SEO tools").

- Rival Identification: Flag the non-obvious player stealing this intent.

- Counter-Move: deploy a specific strategic pivot (not just a feature copy).

This aligns perfectly with the SaaS OODA Loop: Observe, Orient, Decide, Act. You aren't just watching; you are maneuvering.

2025 Data: The Rise of the "Phantom" Competitor

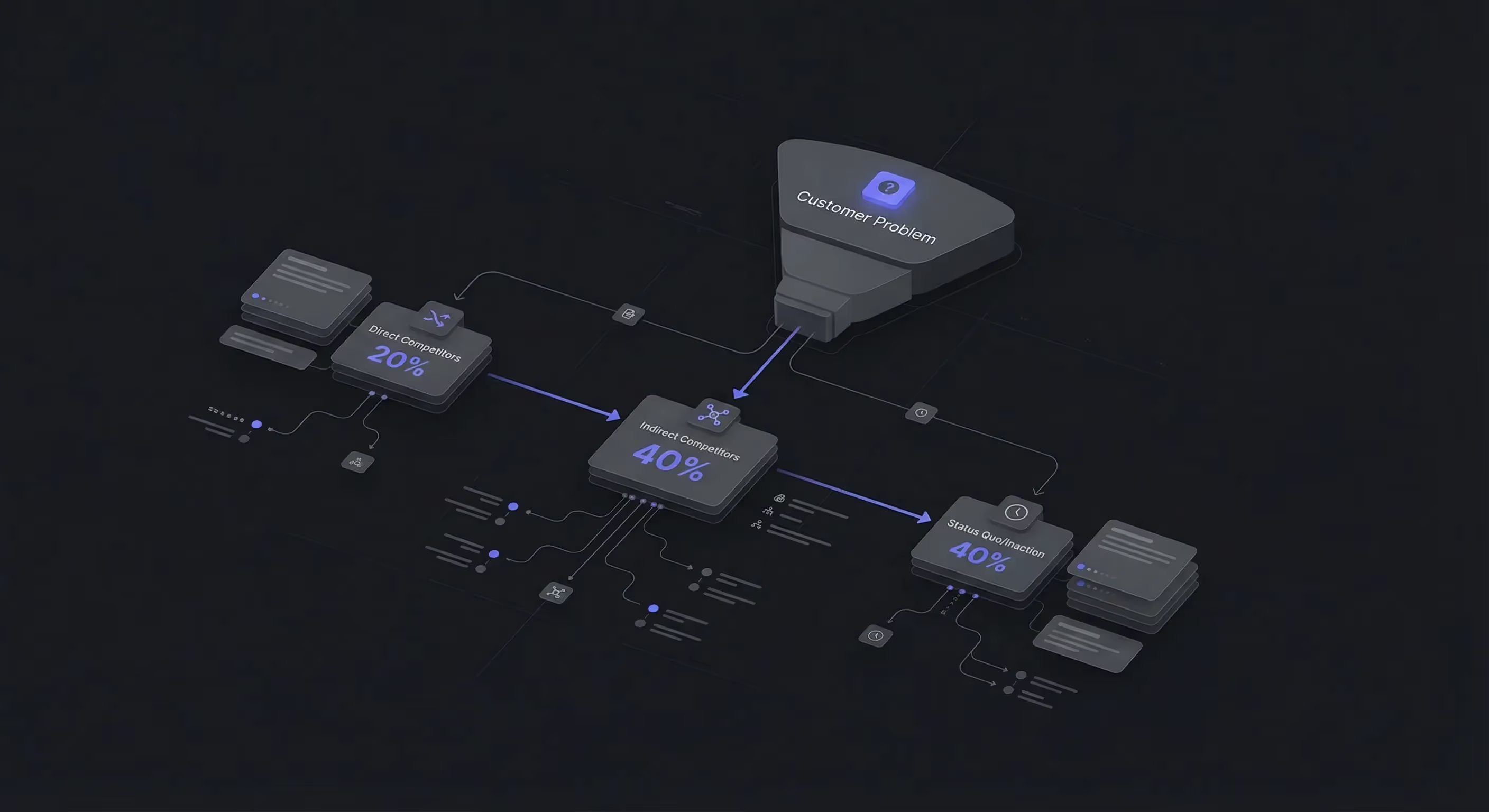

Lensmor found that the definition of competition has fractured into three distinct categories. Understanding this is crucial for survival.

Indirect competitors are dangerous because they change the rules of the game. They don't fight on price; they fight on paradigm.

Read more about this maturity curve in The SaaS Competitive Maturity Model: Are You an Ostrich or a Strategist?.

The Action Plan: How to Crush Indirect Competitors

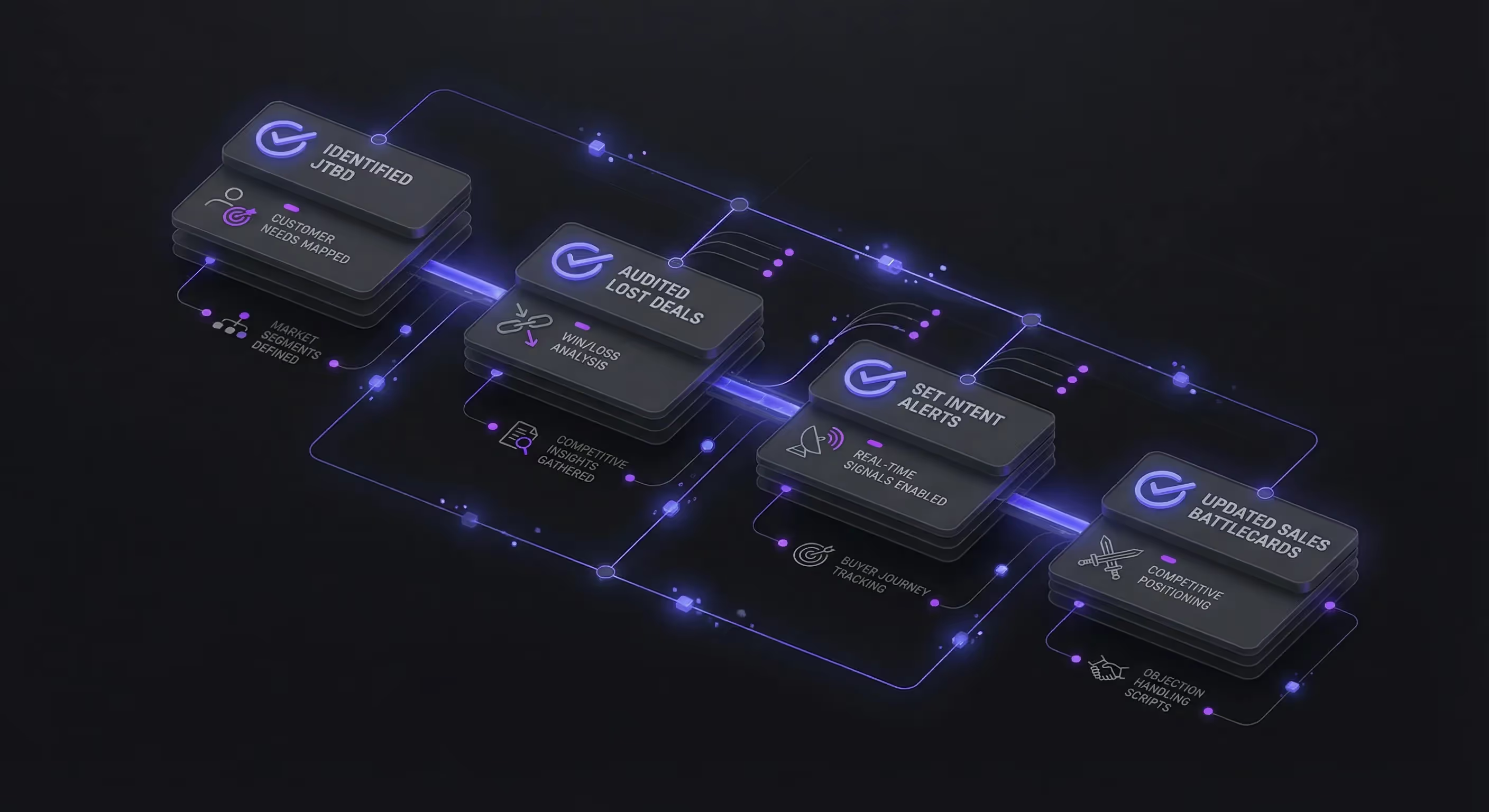

You cannot defeat what you cannot see. Here is your 3-step Agile CI framework to expose and counter indirect threats.

Step 1: Map the "Job to be Done" (JTBD)

Stop asking what your product is. Ask what it does.

- Wrong: "We are an email marketing platform."

- Right: "We help founders get more leads."

- Action: Look at your lost deals in your CRM. Filter by "Closed Lost - No Decision" or "Other." Call 5 of them. You will likely find they didn't choose a competitor; they chose a spreadsheet or a freelancer. That is your indirect competitor.

Step 2: Monitor "Problem Keywords," Not Just Brand Names

Don't just track "Competitor Name" alerts. Track the problem.

- If you sell collaboration software, monitor keywords like "remote team sync issues" or "async work templates."

- Lensmor allows you to set up these intent-based monitors. You will see who is ranking for these terms. It might be a new AI tool you’ve never heard of.

- Reference: 9 Best Competitive Intelligence Tools for SaaS in 2025 (Ranked & Reviewed).

Step 3: Launch a "Counter-Narrative" Campaign

Once you identify the indirect threat (e.g., Notion), do not build Notion's features. Attack their weakness relative to the specific job.

- The Narrative: "Notion is great for notes, but terrible for structured sales data. Stop hacking your CRM and start closing."

- This is a classic counter-move. See more examples in 7 Real-World Competitive Counter-Moves (And How to Execute Them).

Why Most Competitive Intelligence Tools Fail

Most tools are built for the "Old Way." They give you a daily digest of 500 screenshots. This is "Monitoring Noise," which we strictly advise against in Stop Monitoring Noise: Why 99% of Competitor Alerts Are Useless.

Lensmor is different because we filter for significance. We use AI to determine if a change actually impacts the intent of the buyer.

- Standard Tool: "Competitor X changed their footer." (Who cares?)

- Lensmor: "Competitor X just launched a 'Notion Import' tool, targeting your indirect weakness." (Actionable).

Check out our breakdown of the stack here: The 2025 Market Intelligence Stack: Top 10 Tools for SaaS Founders (Ranked).

FAQs

Q: How do I find my indirect competitors if I don't know who they are?

A: Start with your SEO data. Look at the "People Also Ask" section in Google for your primary keywords. If you sell "Time Tracking," and people ask "How to track time in Excel," Excel is your indirect competitor. Also, analyze "Closed-Lost" notes in your CRM for mentions of "doing it manually" or "using [Unrelated Tool]."

Q: Should I mention indirect competitors in my marketing?

A: Yes, but be careful. Don't name them to trash them; name them to highlight the gap. "Love Notion? So do we. But for complex project management, you need engines, not just wikis." This validates the user's choice while positioning your tool as the necessary upgrade.

Q: Is "doing nothing" really a competitor?

A: It is the biggest one. This is often called "Status Quo" competition. In 2026, with budget cuts, "doing nothing" is the default choice. You beat this not by comparing features, but by showing the high cost of inaction.

Conclusion: Don't Be a Casualty of the Unknown

The SaaS graveyard is full of companies that had better features than their direct rivals but were made obsolete by an indirect competitor they ignored.

In 2026, your survival depends on your peripheral vision. Stop staring at your direct rivals. Start staring at your customer's problems.

Don't let the next shift in the market catch you off guard. Adopt Agile CI today.

Ready to see what you’re missing?

Stop guessing. Start winning.Join the Lensmor Waitlist and get the Agile CI template that helps you spot threats before they impact your revenue.