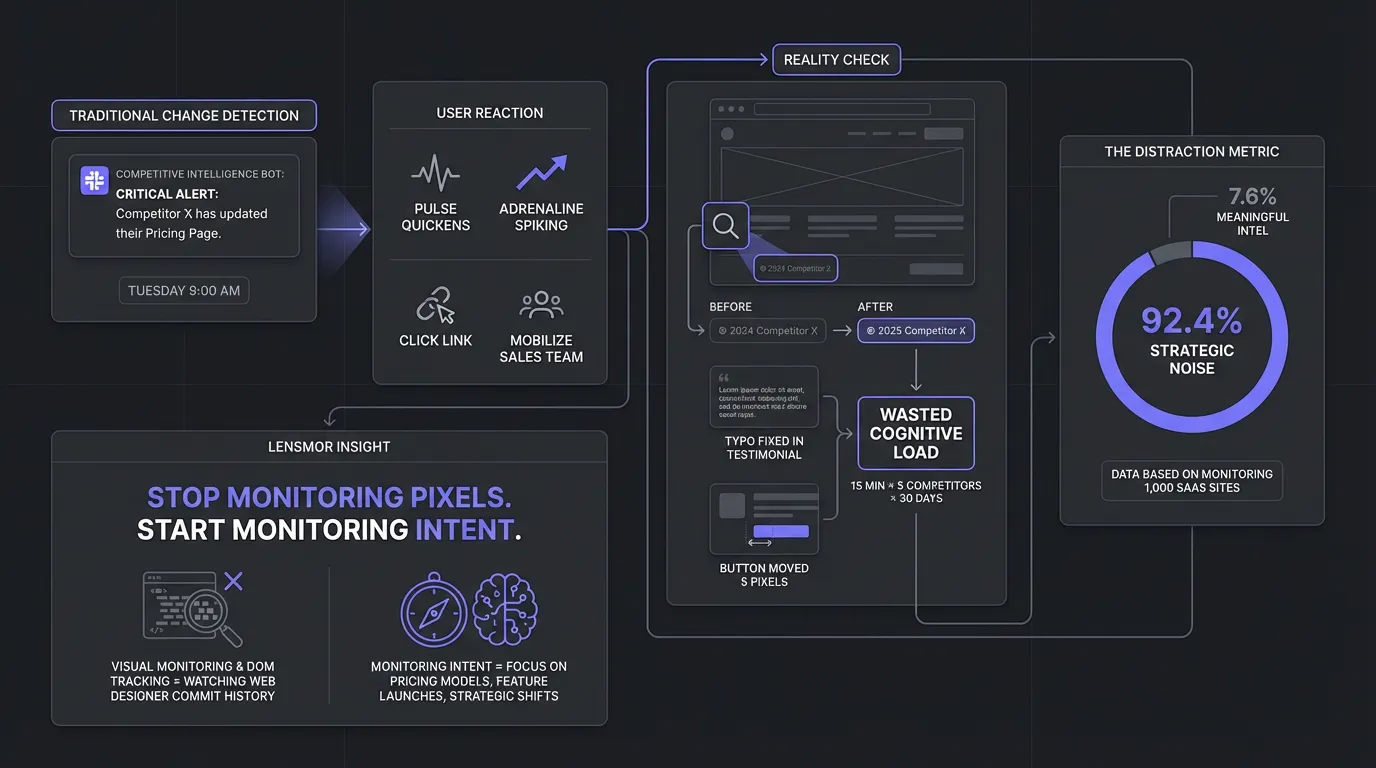

TL;DR:If your inbox is flooding with alerts because a competitor changed a footer margin or fixed a typo, your competitive intelligence strategy is broken. This post explains why legacy visual monitoring (pixel-peeping) generates 92% false positives and how the shift to semantic analysis allows you to ignore noise and focus on actual strategic shifts. We compare the two methodologies and provide an action plan to fix your signal-to-noise ratio.

You know the feeling. It’s 9:00 AM on a Tuesday. You receive a Slack notification from your competitive intelligence bot: "CRITICAL ALERT: Competitor X has updated their Pricing Page."

Your pulse quickens. Did they drop their Enterprise tier? Did they switch to usage-based pricing? Did they launch that feature you’re still building?

You click the link, adrenaline spiking, ready to mobilize the sales team.

The reality? They changed the copyright year in the footer from 2024 to 2025.

Or worse, they fixed a typo in a testimonial.Or they moved a button 5 pixels to the left.

You just wasted 15 minutes of cognitive load on absolutely nothing. Now, multiply that by 5 competitors and 30 days a month. This isn't "intelligence"; it is distraction.

After monitoring 1,000 SaaS sites over test period, Lensmor found that 92.4% of alerts generated by traditional "change detection" tools were strategic noise.

If you are using tools that rely on visual monitoring or DOM-element tracking, you aren't watching your competition; you are watching their web designer’s commit history.

It is time to stop monitoring pixels and start monitoring intent.

The Old Way: The "Pixel-Peeping" Trap

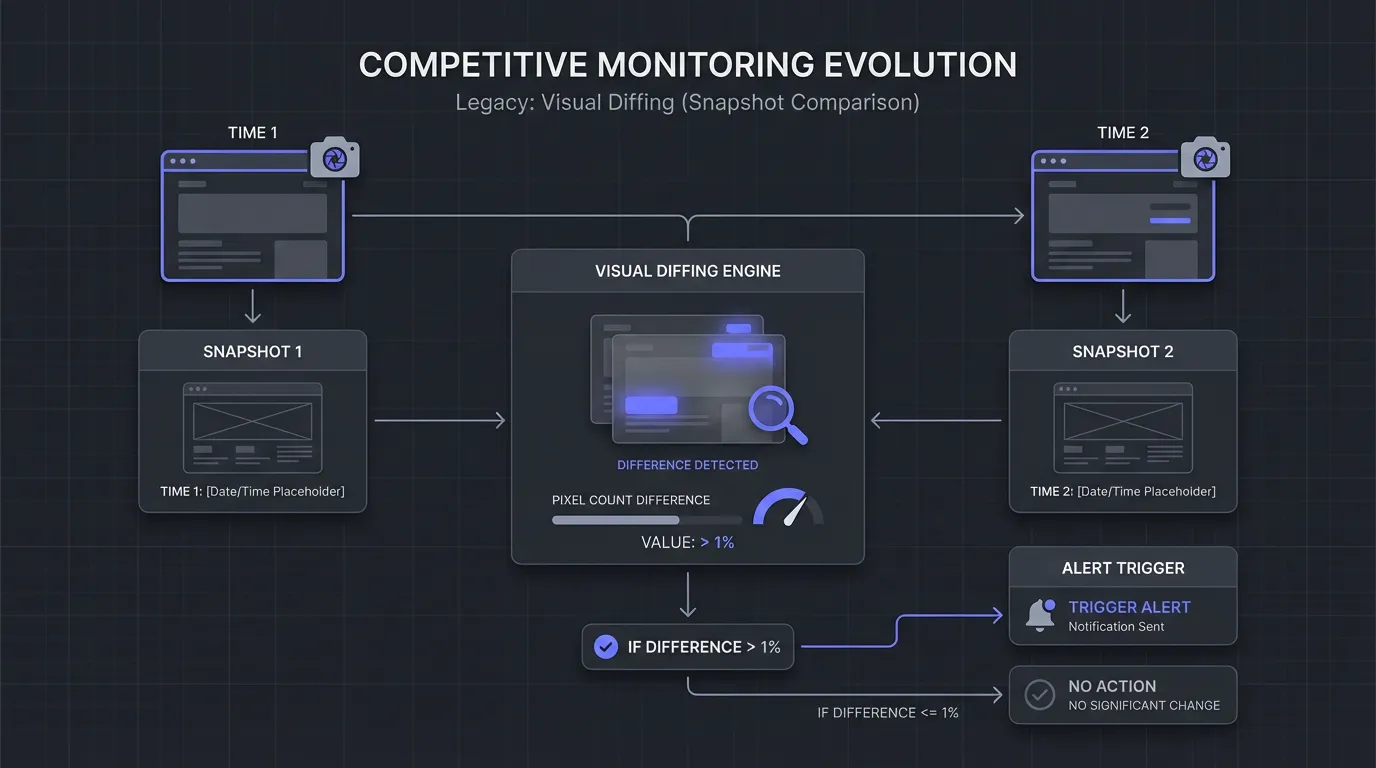

For the last decade, competitive monitoring has relied on a primitive technology: Visual Diffing (or Snapshot Comparison).

Tools like Visualping, generic web scrapers, and legacy CI platforms work on a simple, binary premise:

- Take a screenshot of URL

Aat Time1. - Take a screenshot of URL

Aat Time2. - If Pixel Count difference > 1%, trigger an alert.

Why Visual Monitoring Fails Modern SaaS

In the static web of 2010, this worked. Today, the web is dynamic.

- A/B Testing: Dynamic content loads differently for every user.

- Responsive Design: A slightly different viewport width shifts elements, triggering a false positive.

- Micro-Animations: A loading spinner or a hover state captured at the wrong millisecond looks like a "website overhaul" to a visual scraper.

The result is Alert Fatigue. When your team receives 50 alerts a week and 49 are useless, they stop checking the 50th one. That 50th one was the competitor lowering their price by 20%—and you missed it because you were trained to ignore the boy who cried wolf.

As we discussed in 《The SaaS Competitive Maturity Model: Are You an Ostrich or a Strategist?》, staying in this reactive, noise-heavy state keeps you at the bottom of the maturity curve.

The Core Problem: Visual vs. Semantic Analysis

To fix this, we have to understand the fundamental difference between seeing a page and reading a page. This is the battle of Visual vs. Semantic.

What is Visual/DOM Monitoring?

This method looks at the structure of the code or the pixels on the screen.

- The Trigger: "The HTML code for this

divchanged" or "This image is new." - The Blind Spot: It has no context. It cannot distinguish between a typo fix (

teh->the) and a positioning change (We help SMBs->We help Enterprise). To a visual tool, both are just "text changes."

What is Semantic Analysis?

This is the Lensmor Methodology. It utilizes Large Language Models (LLMs) to analyze the meaning and intent behind the change.

- The Trigger: "The value proposition in the H1 header shifted from 'Speed' to 'Security'."

- The Filter: It recognizes that a footer link changing color or a copyright date update is irrelevant to your business strategy.

Comparison: Visual vs. Semantic Monitoring

The New Way: Agile CI and Intent Recognition

The future of market intelligence isn't about capturing every change; it's about capturing the right change. This is the foundation of Agile Competitive Intelligence (Agile CI).

At Lensmor, we built our engine to replicate the brain of a Product Manager, not a web crawler. Here is how we filter the noise that other tools let through.

1. The "Footer & Nav" Suppression Field

Data shows that 40% of website changes occur in the header (navigation) or footer.

- Scenario: A competitor adds a "Careers" link to their footer.

- Visual Tool: Sends an alert.

- Lensmor: We segment the page structure. We identify the

<footer> and<nav>regions. Unless you have specifically asked to track hiring velocity, our semantic engine classifies footer links as "Low Priority" and suppresses the notification.

2. Typo and Formatting Correction

- Scenario: Competitor changes "Optimize your workflow" to "Optimise your workflow" (US to UK spelling).

- Visual Tool: Sends an alert highlighting the word change.

- Lensmor: The semantic engine compares the vector embedding of Sentence A vs. Sentence B.

- Embedding A:

[0.23, 0.88, -0.12] - Embedding B:

[0.23, 0.88, -0.12] - Result: The semantic distance is near zero. The intent hasn't changed. No alert is sent.

- Embedding A:

3. Recognizing "Intent Shifts"

This is where the magic happens. We don't just tell you text changed; we tell you why.

- Scenario: Competitor H1 changes from "The #1 Accounting Tool for Startups" to "The #1 Accounting Suite for Mid-Market Finance Teams."

- Lensmor Analysis:

- Target Audience Shift: Startups -> Mid-Market.

- Product Scope Shift: Tool -> Suite.

- Action: This triggers a High-Priority Strategic Alert.

This aligns perfectly with the concepts we explored in 《The Age of Agile Intelligence: Why Static Competitive Strategy is Dead in 2026》. You need to know about the strategic pivot immediately, without wading through 50 emails about font sizes.

The Action Plan: Purge the Noise

If you are currently relying on competitor monitoring tools that are flooding you with noise, here is your immediate action plan.

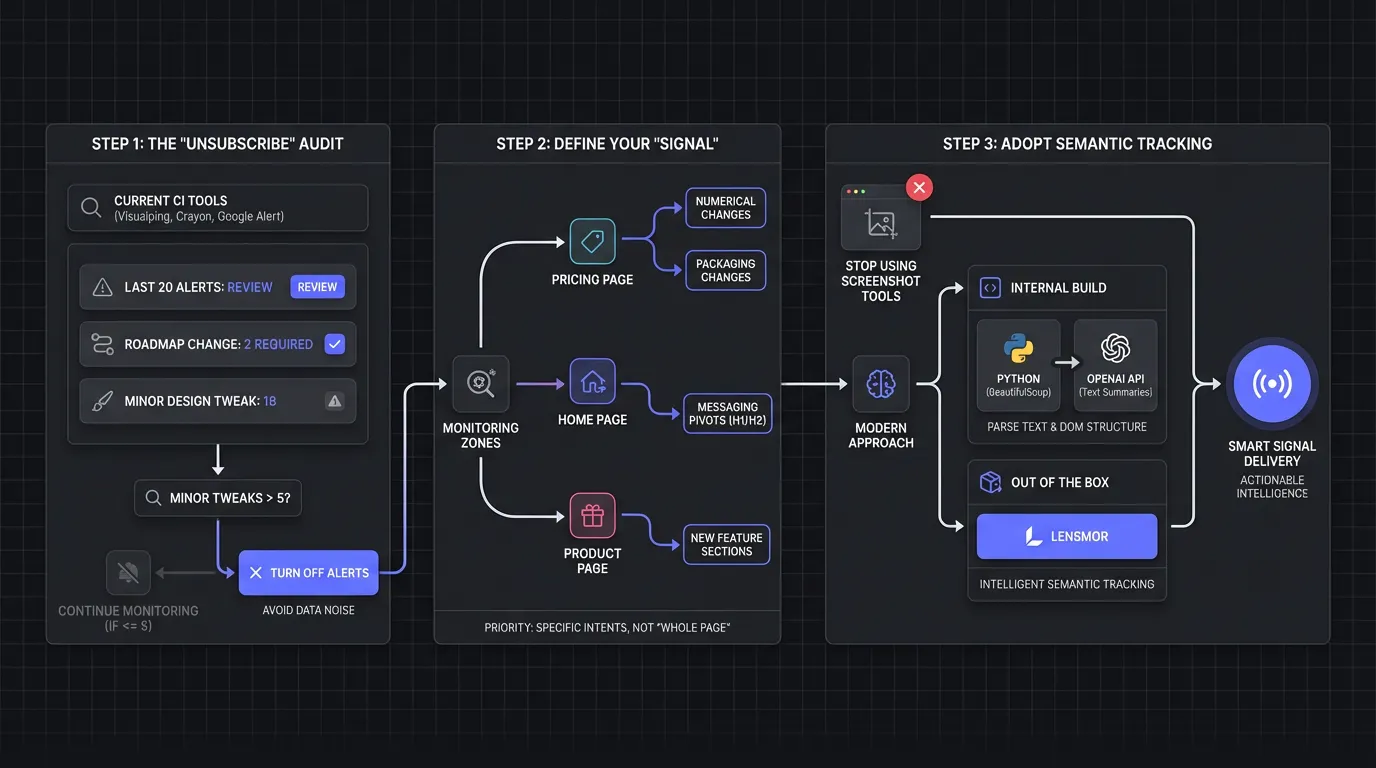

Step 1: The "Unsubscribe" Audit

Go into your current CI tool (Visualping, Crayon, or even a Google Alert). Look at the last 20 alerts you received.

- How many required you to change your roadmap?

- How many were minor design tweaks?

- If the answer to the second question is "more than 5," turn off the alerts. You are training yourself to ignore data.

Step 2: Define Your "Signal"

Before setting up new monitoring, define what actually matters. Do not monitor the "Whole Page." Monitor specific zones for specific intents:

- Pricing Page: Monitor for numerical changes and packaging changes.

- Home Page: Monitor H1/H2 for messaging pivots.

- Product Page: Monitor for new feature sections.

Step 3: Adopt Semantic Tracking

Stop using screenshot tools. You need a tool that parses text and DOM structure intelligently.

- If you are building this internally, use Python libraries like

BeautifulSouppaired with an OpenAI API call to compare text summaries, not raw HTML. - If you want this out of the box, this is exactly what Lensmor was built for.

Conclusion: Silence is Golden

In competitive intelligence, silence is not a lack of data. Silence is a lack of noise.

When your monitoring tool stays quiet for three days, it shouldn't make you nervous. It should make you confident that when it does ping you on the fourth day, it’s because something earth-shattering just happened.

Don't let competitive intelligence noise distract you from building a better product. The goal isn't to know everything your competitor does; it's to know the few things that threaten your existence.

Ready to turn down the noise?

Lensmor’s semantic engine filters out 99% of web clutter to deliver pure signal. Stop reading diff logs. Start reading strategy.

Join the Lensmor Waitlist to get early access to the first true Semantic CI platform.

Frequently Asked Questions (FAQs)

Q: Can semantic analysis miss small but important changes?

A: Unlike visual monitoring, semantic analysis focuses on meaning. If a change is "small" visually but carries "big" meaning (like changing "Free" to "$10"), semantic tools catch it because the intent is vastly different. If the change is small and meaningless (a typo), it is intentionally ignored.

Q: How does Lensmor handle A/B testing on competitor sites?

A: A/B tests are a nightmare for pixel-based tools. Lensmor uses multi-region sampling to identify if a change is a permanent rollout or a temporary test. We also aggregate data over time to show you the "Winning" variation, rather than alerting you on every flicker, a concept we touch on in our《How to Do Competitive Analysis for AI SaaS》 guide.

Q: Is visual monitoring ever useful?

A: Visual monitoring has its place for designers who need to track brand consistency or UI trends. However, for Founders, PMs, and PMMs focused on strategy, it is the wrong tool for the job.

Q: How does this integrate with my existing stack?

A: Effective CI should feed into your daily workflow. As detailed in 《The 2025 Market Intelligence Stack》, Lensmor integrates directly with Slack and Notion, pushing only high-confidence semantic alerts to your team.

Q: Does Lensmor track hidden changes like new landing pages?

A: Yes. Beyond just monitoring existing pages, we use sitemap analysis and SERP signals to detect orphaned or hidden pages before they are fully linked. This allows you to execute proactive strategies rather than reactive ones, similar to the tactics discussed in 《7 Real-World Competitive Counter-Moves》.